Policies are in place to stimulate development of digestate markets across the United Kingdom. Research provides strong support but challenges still remain.

David Riggle

BioCycle October 2012, Vol. 53, No. 10, p. 44

The UK government’s “Anaerobic Digestion Strategy and Action Plan” annual report recognizes the value of digestate: “When used effectively and appropriately, it is a valuable fertilizer which can directly replace other inorganic fertilizers.” An example of liquid digestate application on cropland is shown. (Photos courtesy of John Rennie & Sons and Bryan Lewens.)

All but one of the AD sites in the UK produce electricity; the exception, a farm-fed site, injects biomethane into the gas grid. In terms of potential, the waste-fed plants have a processing capacity of over 4 million tons/year, enough to theoretically generate 54 MW of electricity. Including the 146 AD plants in the water industry treating sewage, WRAP/NNFCC estimate an overall capacity to process over 5.5 million tons of feedstock each year, making more than 170 MW of electricity.

Clearly, things are on an upward trajectory. However — as can be inferred from the 2011 baseline figures — so far it’s been a guaranteed financial return for electricity, and more recently heat, that have been the AD headline grabbers and investment hooks, not the inherent value of digestate.

Small plants (5 MW) that receive accreditation from the Office of Gas and Electricity Markets (OFGEM) can also qualify for additional financial support in the form of Renewable Obligation Certificates (ROCs) that currently provide around £40/MWh ($64). So if an AD plant qualifies for 2 ROCs per MWh, the additional income can add up. (The UK government recently confirmed that small plants can continue to apply for additional financial support under ROC.) One industry commentator noted that at this stage a number of plants “couldn’t possibly operate without ROCs.” The OFGEM website provides some evidence of that by listing the ROCs claimed each year. One plant in the south of England claimed £750,000 (about $1.2 million) of income for a digester processing about 55,000 tons/year. In addition, the Renewable Heat Incentive subsidy for a range of technologies, including anaerobic digestion, was launched in 2011. It provides a guaranteed payment per kWh of renewable heat, biogas or biomethane generated over 20 years3.

Considering the UK Government’s commitment to the 2009 European Renewable Energy Directive, this emphasis on energy is understandable. The UK has set a target to increase the amount of energy consumed from renewable sources from 1.5 percent in 2005 to 15 percent by 20204. The incentives provide some initial encouragement to help get new plants up and running — but clearly aren’t the only type of support required.

“Over the last couple years there’s been significant support from the Government and through WRAP, Zero Waste Scotland and similar bodies to develop AD,” says Louise McGregor, Head of Market Development for Zero Waste Scotland. “We have made some good progress, and I think WRAP and other stakeholders have been helping to change the emphasis from energy generation alone to include the other necessary aspects for a successful plant. We’re involved at WRAP and Zero Waste Scotland because it’s about resources and resource recycling. So if you ignore the digestate part of it, we think you lose a lot of the reason for doing it in the first place.”

Digestate Developments

The amount of material left after the methane/biogas has been extracted is either going to be an additional financial burden if it must be disposed at cost, or a fertilizer benefit and another potential source of income. In either case, there will be a significant quantity to deal with. How much depends on the feedstocks and the type of AD process, but the website for the Energen Shanks facility near Cumbernauld in Central Scotland shares this helpful explanation: “If …for instance, our feedstock was 100 tonnes of vegetable residues (with about 78% water content), and after digestion we would be left with 84 tonnes of digestate, the missing 16 tonnes having been converted to biogas. After dewatering the 84 tonnes of digestate we would be left with 68 tonnes of liquor and 16 tonnes of solid fiber; both the liquor and the fiber contain substantial amounts of nitrogen and other soil nutrients plus large amounts of organic material useful for application to farmland.5”

A WRAP study in 2009 states that “the average digestate production from manures is one metric ton of digestate per metric ton of feedstock, though this varies with the dry weight percentage. Municipal and industrial wastes tend to generate less digestate due to the lower moisture content of the waste and greater loss through biogas production. Food waste digestion from municipal collections gives a digestate product of 83 percent together with 17 percent biogas…6”

By these estimates, given that the waste-fed AD plants in the UK alone have a combined processing capacity of over 4 million tons/year, which could potentially produce 3.4 million tons of whole digestate annually, designing processes that provide usable outputs are very important. “Because you’re not getting such a reduction in volume through an AD process as you do, say, through a composting process, you are having to deal with a large output at the back end of the site,” notes McGregor. “So if you can’t utilize it, you’ve got a big storage problem on your hands.”

The UK government’s “Anaerobic Digestion Strategy and Action Plan — Annual Report 2011/12,” published in July 20127, recognizes the need to focus on this area by clearly stating: “…Having safe and secure markets for digestate is crucial to the success of the AD sector… Digestate from AD plants is still considered a relatively new material. …. When used effectively and appropriately, it is a valuable fertilizer which can directly replace other inorganic fertilizers. There is a need to develop markets for digestate, and to build confidence within those markets on the safety and efficacy of its use. Lack of such markets could significantly constrain the development of the AD sector in the future, and will be a missed opportunity to recycle valuable nutrients to the soil.”

Studies And Reports

Thanks to the attention by WRAP, Zero Waste Scotland and others, there is a growing base of carefully thought out research on digestate use that is being regularly reviewed. For instance, the Anaerobic Digestion and Composting Research Network UK (ADCORN-UK) produces a “Matrix of [Government funded] Research & Development”8. It doesn’t include work by private institutions, but provides a good overview for anyone looking for a quick summary of research priorities in the UK, including, for example, “Joint WRAP/DEFRA Field Experiments With Composts And Digestates On Sites Across Great Britain” and “Examination of Digestate Stability And Odor.” (DEFRA is the Department For Environment, Food and Rural Affairs, part of the UK government.)

An excellent report to come out of this type of collaborative research is “Digestate Market Development in Scotland,” published by Zero Waste Scotland in 2010.9 It is a thorough examination of the growing use of AD in Scotland, locations, capacities and feedstocks of plants, and an evaluation of potential markets from restoration of derelict land through forestry, horticulture and agriculture. To someone looking at this assessment from outside the UK, perhaps two of the most apparent underlying themes are the focus on source separated feedstock, and the importance of quality certification schemes like PAS 110 (see next section) that allow a determination to be made that the digestate is, in fact, a product and no longer a waste.

A key component of the recently passed Waste (Scotland) Regulations — which convey a vision of all waste as a resource — is a distinct preference for source separated as opposed to mixed waste systems overall. In terms of output from AD processes, if it is a technology such as Mechanical Biological Treatment (MBT) including AD to extract biogas, the resulting material currently has very little positive future. “The source of digestate feedstock is considered to represent a barrier [to the use of AD],” states the study, “particularly as material produced wholly or partly from mechanically biologically treated waste will not quality for PAS 110 digestate certification or be viewed as recycling by the Scottish Environment Protection Agency (SEPA).”

PAS110 And ‘End Of Waste’

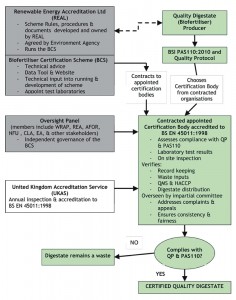

How a ‘waste’ becomes a ‘product’ (or at the very least no longer a ‘waste’ and subject to waste regulations) is a subject fraught with complexity and minutiae. There are currently three perspectives on this issue in relation to digestate: Scotland’s, England, Wales and Northern Ireland’s, and Europe’s. Fortunately, clear step-by-step guidance for the first two of those perspectives is available through the Renewable Energy Association’s Biofertilizer Certification Scheme (BCS)10. BCS was created to certify “biogas plants….for the production and use of Quality Outputs from the anaerobic digestion of source separated biodegradable wastes” across the UK.

In Scotland, SEPA has determined that adherence to the British Standards Institute (BSI) Publicly Available Specification (PAS) 110 for producing quality anaerobic digestate,11 along with a few additional conditions, is sufficient to exclude the digestate from waste regulatory controls, meaning it can be used freely assuming there is a market. In England, Wales and Northern Ireland, in addition to PAS 110, a Quality Protocol (QP) also is required to clarify “the point at which waste management controls are no longer required.”

The additional factor waiting in the wings while the final phases of consultation are carried out is the proposed European-wide “End-of-waste Criteria for Biodegradable Waste Subject to Biological Treatment.12” The criteria are being developed by the Joint Research Council (JRC) in Seville, Spain, supporting the European Commission’s efforts to determine when a biowaste-derived product like compost or digestate is of high enough quality to no longer be considered waste across all member states.

In this area, the UK has forged ahead and already developed its own ‘End of Waste’ criteria, as noted above. WRAP, DEFRA and other UK bodies have fed extensively into the European consultations managed by the JRC, but the second round of proposals had some industry groups concerned that the final criteria would not take into account AD plants handling food waste in the UK, and would perhaps be more biased in some of its tests towards farm-based and crop-fed digestion operations such as are more common in Germany.

A third working document was released by the JRC in August 2012, which widened the range of possible inputs to include sewage sludge and biowastes mechanically separated from mixed wastes. These inputs are not permitted under the UK’s existing ‘End of Waste’ approaches, and the UK — together with a number of other European Member States — has objected to their inclusion. However, with a revised (final) report not expected until later this year, it’s not entirely clear what the eventual proposal will include.

The European Commission is not obliged to bring forward a regulatory proposal based on the final recommendations of the JRC. If it does, then the regulatory proposal will be subject to negotiation with EU Member States prior to voting, which would be unlikely to take place until the latter part of 2013 at the earliest. If a European regulation is adopted, it would have direct application to all Member States, including the UK, and would replace the existing End of Waste approaches in Scotland, England, Wales and Northern Ireland.

Prospects And Limitations

The actual fertilizer value of digestate from AD plants, especially those handling food waste, is significant. The type of product also is different than the green or food waste composts to which markets are starting to become accustomed. The three basic forms are whole (liquid + fiber), liquid (separated) and fiber (separated). The most common in the UK at present is whole digestate, which is primarily liquid and so requires tanker/land injection application equipment as is used with livestock slurries, rather than a spreader for something dark and crumbly.

“Digestate has very different properties from compost,” explains Jane Gilbert, an organic resources specialist and past executive director of UK Composting Association (now AfOR). “Most nitrogen is readily available for plant uptake, whereas with compost sometimes less than 10 percent of the nitrogen will be available for plant uptake in the first year. It’s really more of a ‘biofertilizer’ than a long term ‘soil improver’ like compost, so the properties are very different.”

WRAP/DEFRA Digestate & Compost in Agriculture field experiments have indicated typical nutrient values of 5.0 kg/t for nitrogen (N), 0.5 kg/t phosphorus (P) and 2.0 kg/t of potassium (K) for whole digestate. Green waste compost and green/food waste compost at 7.5 and 11 kg/t respectively both have higher N content, but 80 percent of the digestate N is readily available, where only between 2 and 5 percent of the compost’s N is available for uptake by plants in the first year13. “This high level of nutrient availability means that digestate can be used as a direct replacement for ‘bagged’ N fertilizer,” says the report. “Current guidance is that 60 percent of this readily available N may be taken up by crops in the year of application, assuming spring band spread application (using pig slurry as a proxy).”

Jointly funded by DEFRA, WRAP, WRAP Cymru and Zero Waste Scotland, the Digestate & Compost in Agriculture project14 is working to make the research results accessible to farmers and growers, the project website notes. Project partners for the field experiments underway include ADAS (before privatization called the Agricultural Development Advisory Service), Earthcare Technical, Rothamsted Research, East Malling Research, Harper Adams University College and Scottish Agricultural College. This involvement of partners across the UK is indicative of broad support to develop information that ultimately will make informed decisions on use easier.

Another interesting tool is a draft ‘Biofertilizer Matrix’ that David Tompkins of WRAP began developing in 2010. The stated aim was to produce “a set of biofertilizer use/benefit documents that outline how best to utilize biofertilizers in different Great Britain agricultural land uses.” Partly a risk-based assessment of digestate use for a crop quality assurance audience and partly a use/benefit guide to best practice for farmers and growers, the matrix is expected to be published next year. A draft version available earlier this summer notes: “Digestates are an alternative to manufactured fertilizers and by using them, farmers and growers can improve the sustainability of their cropping systems, whilst saving money on purchased fertilizer. Preliminary calculations indicate that the fertilizing value of digestate can save 25 kg CO2 equivalent per cubic meter of digestate used — an increasingly important consideration for retailers, who are seeking to reduce carbon emissions throughout their supply chain.” The document also provides guidance on best times of the year for application for specific crops, and advises using “a bandspreader (trailing hose/ trailing shoe) or shallow injector, which will reduce ammonia losses (and odor nuisance) compared to surface broadcast application.”

Potential cost projections of digestate’s fertilizer replacement value also are being researched. WRAP’s “Digestate & Compost in Agriculture Bulletin 2-November 2011” points readers to the ‘compost/digestate calculator’ on WRAP’s website15 for a quick way to calculate the financial value of a biofertilizer’s N, P and K. It uses current market prices for fertilizers and typical nutrient content figures for compost and digestate. In September 2012, the financial value of nutrients in anaerobic digestate was calculated to be £6.93 (about $11)/metric ton.

Figure 1. Path to product certification (England, Wales and Northern Ireland) (Source: Biofertiliser Certification Scheme (www.biofertiliser.org.uk))

Future Potential

In conclusion, a substantial body of policy and ongoing research is available to support use and marketing of digestates across the UK from central and devolved governments and a wide range of cooperative institutions. However, the digestate market is still very young. “The UK AD industry is going through a developmental process like the composting industry did some 10 or 15 years ago,” notes Jane Gilbert.

Even so, the future looks very positive given the available support. Over the past year, WRAP have launched a £10 million (about $16 million) Anaerobic Digestion Loan Fund designed to support development of new AD capacity in England. Zero Waste Scotland — with the huge drivers of mandatory commercial food waste collections starting in 2014 and the ban of biodegradable waste to landfill by 2020 — are (among other programs) providing assistance to local authorities to assist with collecting food waste that the growing AD industry requires.

As for key tasks in the near future, Louise McGregor suggests: “In this next stage, as research results become clearer, we’ll need to focus more on advocacy for digestate and better present the benefits of the product. Producers will also have to give more thought to manufacturing a product that the customer actually wants, rather than just hoping someone will buy the whole digestate produced by the AD process. As we begin to think in more innovative ways about marketing different products and tailoring outputs to customer needs, we’ll be able to get much more digestate into agricultural, landscaping and regeneration applications where it can benefit us all.”

David Riggle is a former Managing Editor/International Editor of BioCycle and has been living and working in Scotland for the past 14 years. He has been employed by the Waste Services department at Stirling Council since 2001, and before that coordinated development of a Local Agenda 21 Plan with community and environmental organizations in Fife.