Pennsylvania WWTP Fills Food Waste Recycling Demand>

The Hermitage, Pennsylvania municipal wastewater treatment plant (WWTP) underwent a major upgrade in 2014, that included installation of a thermophilic anaerobic digester to produce a Class A biosolids. The facility also expanded its capacity to receive high strength organics, including liquid food waste, packaged consumer food waste, and fats, oils and grease (FOG). “We are a WWTP first and foremost, but food waste has a way of finding us,” notes Tom Darby, manager of the Hermitage Municipal Authority. “We are codigesting about 10,000 gallons/day of food waste, which is about 30% of our daily throughput. Over the last 5 years, revenues from tipping fees have averaged $150,000 to $200,000/year.”

Food Waste to Energy – Butter from Tom Darby – Organic Energy on Vimeo.

Hermitage started out with an REM depackager, which it now uses to perforate plastic containers that have liquid in them. “We take 2 to 3 truckloads a week of milk, yogurt, sour cream, cottage cheese, etc.,” adds Darby. “There is a dairy 7 miles away and we knew it was hauling 2 truckloads/week of dairy waste to dispose in Michigan, as they drove past our door to get on the interstate.” To manage nonliquid, packaged food, the WWTP procured a Scott Turbo Separator. Most recently, it added a Veolia ECRUSOR that utilizes a screw press, resulting in less shattered plastic.

All food waste goes to a hydrolysis tank where it begins heating, and then to a prefeed sequencing tank to be thickened with sludge before being loaded into the thermophilic digester, followed by mesophilic digestion. Biogas is used to generate electricity; the plant’s monthly electric bill has been whittled down to $5,000/month from $25,000 to $30,000/month. Producing Class A biosolids (10 tons/day) for land application also is saving the Hermitage WWTP money — it had been paying about $8,000 to $10,000/month to dispose Class B solids.

Unlocking Global Biogas Potential

At COP25, the United Nation’s climate change meeting in Madrid in December, the World Biogas Association (WBA) called on governments around the world to unlock the full potential of biogas in addressing the climate emergency. According to WBA, if all barriers were removed, the biogas industry could abate up to 4 billion metric tons of CO2 equivalent annually, representing at least 12% of today’s global emissions, by 2030. Today only 2% of the feedstock available globally to produce biogas is captured and recycled.

In its recent report, the Global Potential of Biogas, WBA estimated that there currently are 132,000 industrial biogas plants (including anaerobic digesters and landfills) operating globally. By 2030, at least 1 million large-scale installations are needed (each handling over 100,000 metric tons/year of feedstock), along with millions of smaller scale digesters, to achieve the emissions reductions targets. The sector will need to invest some $5 trillion to design, build and operate those plants; all barriers to those investments existing today must be eliminated if the industry is to achieve its goal. If deployed to its full potential, WBA estimates that the industry would employ around 10 million people worldwide, from 350,000 currently.

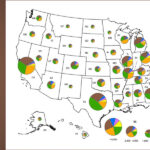

RNG Supply Assessment

The American Gas Association (AGA) released a report in December 2019, Renewable Sources Of Natural Gas: Supply And Emissions Reduction Assessment, which outlines the potential domestic resource base for renewable natural gas (RNG), the corresponding potential for emission reductions, and associated costs. Conducted by ICF for AGA, the study estimates that by 2040 approximately 4,513 trillion Btu of RNG could be produced annually. Additionally, this equates to a 235 million metric ton reduction in GHG emissions, or a 95 percent reduction in emissions from the natural gas residential sector. ICF found costs competitive with other GHG emission abatement options, beginning at $55/metric ton of CO2 emissions. Production potential estimates were developed by incorporating a variety of constraints regarding accessibility to feedstocks, the time it would take to deploy projects over the timeline of the study (out to 2040), development of technology required to achieve higher levels of RNG production, and consideration of likely project economics.