When BioCycle began its State of Garbage In America survey reports in the late 1980s, it was common for nascent state recycling and composting programs to be funded by a surcharge on landfill tipping fees. Fast forward 30+ years, and while many states still have a “trash tax,” very little is likely allocated to help fund landfill diversion. So when Edgar & Associates, a Sacramento, CA-based consulting firm, sent out a detailed policy proposal on Tip Fee Reform a couple weeks ago, it drew our interest. The purpose of the proposed reform is to provide incentives to fund SB 1383 infrastructure to manage organic waste streams required to be diverted from disposal. For a number of years, funding for grants awarded by CalRecycle came from the state’s Cap & Trade funds distributed as California Climate Investments. But significant budget tightening due in part to the state’s COVID-19 response means that this source of money — along with grants from the California Energy Commission — will be curtailed.

One place to turn to help fund SB 1383 infrastructure is California’s landfill tip fees. “Reform of the $1.40/ton state tipping fee (previously $1.75/ton from 1990-1993) to fund the Integrated Waste Management Act (IWMA) needs to be discussed,” states Edgar & Associates‘ Tip Fee Reform Proposal. “If the simple CPI (Consumer Price Index) factor had been applied, the IWMA Tip Fee could have been $2.50/ton, and could have added $44 million to this year’s budget. There has been over a decade of legislative attempts on tipping fee reform without any success. A $10/ton tip fee would bring in $400 million/year, which is the most robust and obvious mechanism, as 11.6 million more tons have been disposed of since 2014, and the state recycling rate was only 40% in 2018 and could drop to 33% in 2020. The increase in tip fee would discourage cheaper landfill disposal, provide incentives for SB 1383 infrastructure, and stimulate the economy.”

CalRecycle’s “Analysis of the Progress Toward the SB 1383 Organic Waste Reduction Goals” released in mid August, stated the following on the landfill tip fee surcharge: “At the state level, expanded funding could be generated through increases to the landfill tip fee. The landfill tip fee is the IWMA’s principal funding source and supports CalRecycle programs and oversight cost. It was derived from a per ton disposal fee that was capped at $1.40 in 1995 and remains one of the lowest fees in comparison to other states and developed countries. If the tip fee were modernized and adjusted for inflation, it could provide a sustainable funding stream at the state level to support organic waste recycling and disincentivize disposal.”

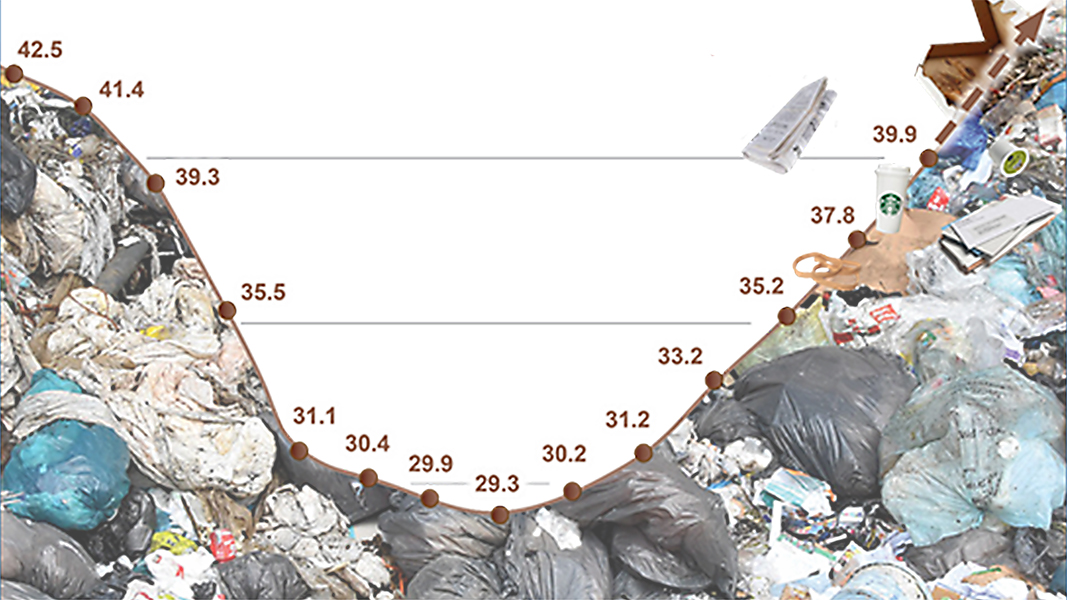

Edgar & Associates’ tip fee reform proposal points out the decline in California’s recycling rate since 2014: “With cheap disposal and lack of infrastructure development, while the China National Sword hit the industry, the statewide recycling rate has dipped from 50% in 2014, 47% in 2015, 44% in 2016, 42% in 2017, to 40% in 2018 and could go as low as 33% in 2020, should the China ban be fully executed as expected. To reverse this dramatic disposal crisis, massive investments are needed for in-state recycling and composting infrastructure funded by a surcharge on disposal. The [newly formed] Statewide Commission on Recycling Markets and Curbside Recycling should address Tip Fee Reform where a $10/ton increase would raise $400 million per year for the IWMA, where $300 million should be earmarked for improving the recycling infrastructure, and where a higher tip fee should be imposed to promote behavioral changes to implement the progressive polices of the State of California.”