Top: Within three years of when compost was first used on the fairways and tee boxes, the Meadows of Sixmile Creek golf course in Wanaukee, Wisconsin was able to replace 100% of its synthetic fertilization and 95% of its chemical herbicides. Compost is supplied by Purple Cow Organics.

Craig Coker

Second of a series of articles on factors to consider when planning a new composting facility in the U.S.

Planning a new merchant organics recycling facility requires considerable thought and investigation. As the old adage goes, “Proper prior planning prevents poor performance.” This facility planning series is oriented to helping you think through the aspects of proper prior planning. Part I covered developing a Waste Capture Plan. Part II focuses on the other end of compost manufacturing: How much compost/soils will the market likely absorb in my geographic area of influence? At this stage, you are not trying to write your three-year Strategic Marketing Plan, but rather gather research that will feed into and guide that future work.

As discussed previously, your geographic area of influence for compost and soil products is, more or less, about a one-hour hauling travel time for bulk sales from your preferred location for manufacturing compost. As travel time is a function of road network capacity and quality, this generally works out to be 50 miles if your site is in a rural area of 2-lane country roads, or, maybe 75 to 100 miles if you’re within five miles of an interstate highway. This rule of thumb applies to bulk sales; bagged product sales have a considerably longer reach of 200 to 250 miles but the added cost of bagging is often a challenge for start-up and first-stage expansion facilities.

Assess Existing And Emerging Markets

The first step in assessing potential product demand is to decide what traditional and emerging compost markets are alive and well in your geography. Residential and commercial landscaping are the bedrock traditional markets for compost and compost-based soils. Agriculture, particularly organic agriculture, is a strong traditional customer, with a growing demand due to increased farmer awareness of the value of soil health coupled with incentive programs for compost use, like the Natural Resources Conservation Service’s CPS 808 Soil Carbon Amendment Interim Standard (see references).

Emerging markets might include: Best Management Practices (BMPs) for storm water runoff control, management and treatment; athletic field infrastructure, maintenance and rehabilitation; green roofs, urban forestry and other vegetative practices designed to reduce the carbon footprint of built infrastructure; and development-oriented (or re-development oriented) minimum soil organic matter content requirements to reduce irrigation demand (in western states) and to improve soil infiltration of rainfall and reduce storm water runoff (and its associated pollutants).

McGill SoilBuilder Premium Compost was used in construction of practice training fields for the Washington NFL team and the University of North Carolina-Charlotte. The fields were leveled, compost was spread and incorporated into the soil, and sod was laid on top.

Residential And Commercial Landscaping

Residential and commercial landscaping is the predominant market for mulch and compost and for some types of compost-based soil blends. Probable uses for compost include ornamental landscape beds, flower and vegetable gardens, and turfgrass establishment and maintenance. Potential methods of compost use are incorporation into the top 6 to 8 inches of soil, incorporation into plant backfill material, loosely spread on the surface of turf as a topdressing, and (more rarely) as a 2-to 3-inch mulch layer. This market has several potential sectors including design professionals (landscape architects and consulting engineers), landscape contractors (installation/maintenance), wholesalers/retailers of landscape soil amendment products, and homeowners/gardeners.

Wholesale landscape material supply yards mainly serve contractors and large residential markets. As such, these businesses often stock bulk inventories of compost-based soils (i.e., manufactured topsoil), some types of rootzone mixes, mulches, gravels, stones, and other similar bulk supplies. The retail landscape material supply distribution chain is heavily dominated by “big-box” stores and generally serves smaller residential customers. As such, these businesses are commonly more interested in bagged products. This is evidenced by local lawn and garden centers increasingly converting the use of their limited space from bulk materials to bagged merchandise.

Homeowners and gardeners represent a significant market share for bulk compost sales. While many residential customers appreciate the convenience of bagged products, there are still a significant number of “pickup truck-load” (1 to 2 cubic yards per purchase) buyers. These buyers are willing to travel some distance to capture cost efficiencies associated with bulk compost purchases, but timely small-scale deliveries and/or more local distribution (through wholesale/retail outlets) are important considerations to sales growth in this market sector.

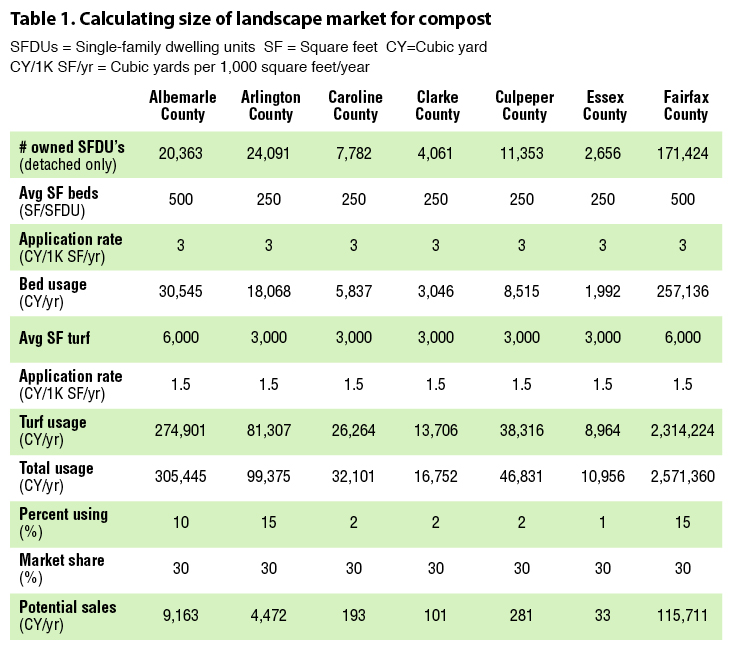

One method of estimating the preliminary size of the landscape market is to assume that owner-occupied single-family dwelling units (O-O SFDUs) will be the predominant users of compost and compost-based soils. Census data includes the number of owner-occupied SFDU’s in your geographic range area (same area as your waste capture plan area discussed in Part I). For each of the cities and counties in the area, assumptions should be made about likely landscaped ornamental bed areas (250-500 square feet (SF)/house), turfgrass areas (1,000–3,000 SF/house in cities, 3,000–6,000 SF/house in counties); percentage of homeowners using mulch, compost or compost-based soils (higher closer in and lesser further out in country); and your (conservative) market share capture percentage (30% of market after three years of marketing/sales). Table 1 is from an analysis I did in Virginia in 2019.

Agricultural Markets

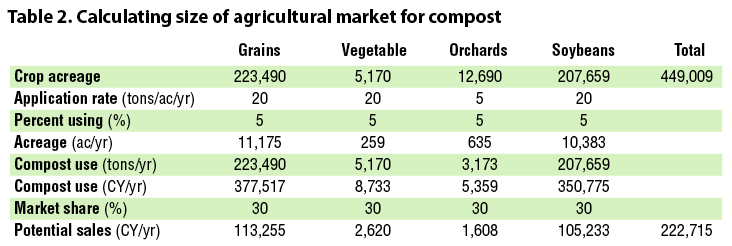

A similar approach can be used with the agricultural market. The quinquennial survey by the U.S. Department of Agriculture’s National Agriculture Statistics Service includes data on acreage planted in each crop type in each county. So, using the same geographic radii as in landscaping markets and waste capture markets, estimate the acreage by crop group, make some (conservative) assumptions about application rates (tons of compost spread/acre), percent of farmers using compost, and market share. Then estimate potential sales. Some of the data from a recent Northern California study I did is shown in Table 2.

Storm Water BMPs

One emerging market of great interest in some parts of the U.S. is vegetated Best Management Practices (BMPs) for storm water pollution prevention. This includes “green infrastructure” like bioswales, bioretention pond growth media, infiltration basins, etc. These “green basins” need a soil blend that will infiltrate storm water on a long-term basis (e.g. > 1”/hour for 5+ years) yet have enough organic matter in the soil blend to support vegetation. Some composters make up an 80% sand + 20% compost blend that complies with most specifications. One consideration is the type of compost used to make the soil blend. In watersheds with an existing phosphorus (P) water quality problem, like the Chesapeake Bay, soil blends may have to be made with a low-P compost, like leaf compost, to meet the project’s specifications on maximum P content.

Green storm water infrastructure, such as this rain garden in Portland, Oregon, is becoming increasingly common to capture and infiltrate rainwater. Compost is often used in the engineered soil mixes for the rain gardens.

Estimating demand for these types of soil blends can be challenging. A bioretention pond basin specification normally calls for a 2.5-foot deep layer of a high infiltration soil blend. One approach I have used is to review a community’s Municipal Separate Storm Sewer System (MS4) Annual Report, which often includes the number of these new vegetated practices built each year. One reasonable assumption is that, if they built 15 new BMP projects in 2021, they may build 15 more in 2022. Estimating the spatial areas of each installation is also challenging, as it is a function of drainage area, but one conservative estimate would be 0.25 to 0.5 acre each for bioretention ponds. Each pond would have a potential soil blend demand of about 2,000 CY.

Mystery Shopping

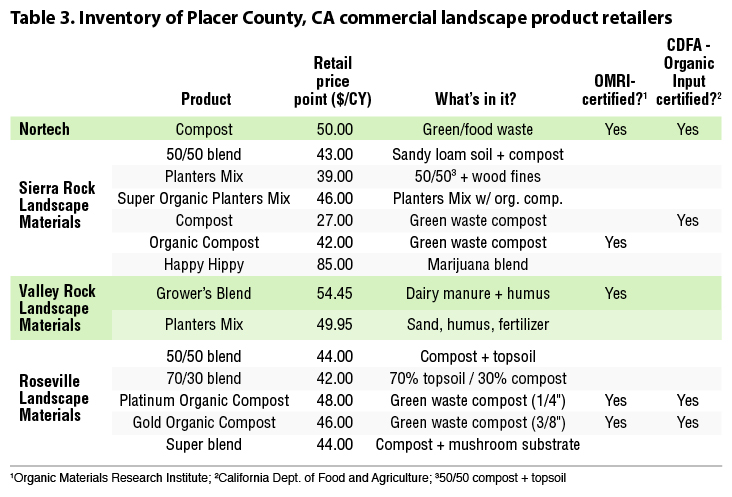

For many, one of the more interesting aspects of compost market research is mystery shopping. Here, in the same 50-mile or 75-mile geography you’re using as an “influence zone,” the goal is to visit every commercial landscaping product retailer. I will go into the store, wander around looking at products on shelves (noting brand names and prices) and go out into the yard to see the bulk items. When I can speak with someone, I will say something like “My brother-in-law told me about compost. Do you know anything about it? Do you carry it, and if so, how much is it?” (Note, if you are well-known in your community, you may have to have a friend or relative do this part.) Not only do you learn about competing products and prices, but you learn how knowledgeable their sales staff are, so you can address that in the Product Sales Support portion of your Strategic Marketing Plan.

A lot of this research can be done by phone, asking the same questions as you would on-site, although you often end up speaking with someone who needs to consult with others. Table 3 includes some of the information I gleaned over the phone on that recent Northern California job.

Forecasting growth in a region requires some research and understanding of historical growth patterns. Traditionally, settled areas in the U.S. tend to grow towards one another along transportation arteries but many communities favor growing in one direction more than others. Local building departments have historical building permit data, sometimes classified by industrial, commercial, and residential. Reviewing these growth patterns, both in time and in space, can give you insights into where to put your marketing resources.

It is also useful to understand larger-scale growth patterns. For example, it is widely reported that the State of Florida is receiving more than 300,000 incoming people from other states (e.g., the population of Orlando) annually. This is driving a huge boom in housing construction in some areas, which, in turn is driving a boom in mulch demand as new homeowners spruce up their yards. This demand jump is so significant, one composter I am working with is changing operations for a while to make more mulch and less compost. If you’re planning a new facility in a high-growth area, these considerations can influence equipment and capital expenses decisions.

Craig Coker is CEO of Coker Composting & Consulting near Roanoke, VA and is a Senior Editor at BioCycle CONNECT. He can be reached at ccoker@cokercompost.com.