Top: Photo/graphic by Doug Pinkerton

Matthew A. Karmel

Mergers and acquisition (M&A) spending by the waste industry reached a historic $6.3 billion in 2022. M&As refer to transactions in which the ownership or assets of companies are transferred. Current allocation of M&A spending to the organics recycling industry is not readily available. But more money is expected to flow to composters and other organics businesses over the next five years as a result of M&A spending. Geography is playing a lot into buyers’ interest, especially in states and jurisdictions with friendly policies and organics mandates. Buyers are seeking to break into new markets and gain footholds and assemble blocks of service providers within a given area.

There are many different types of M&A transactions, and each serve different business objectives and come with specific risks and nuances. Several recent M&A transactions in the organics recycling industry illustrate this point: WM (formerly Waste Management) recently acquired all of the assets of SET, Inc., a Minnesota compost manufacturer; Republic Services acquired North State Rendering Co., Inc., a California anaerobic digestion facility; Atlas Organics acquired Dirt Hugger, a Washington-based composter a little over a year ago, and Atlas Organics itself was acquired by Generate Capital a few months before then; Bootstrap Compost in Boston acquired the organics collection accounts from a Massachusetts-based composter in the latter half of 2022; and Versana has been steadily acquiring green waste composting operations in Florida.

What Do Buyers Need To Know?

Each transaction poses unique issues and considerations. So what do companies need to know about potential acquisitions? These four steps lay the groundwork.

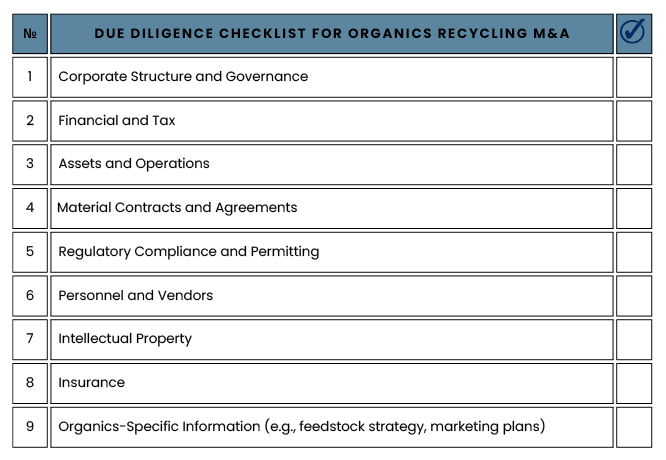

Figure 1. Due diligence checklist for organics recycling mergers and acquisitions. Source: Offit Kurman

Preparing for a Transaction: Before an M&A transaction is completed, the acquiring company will want to do a deep dive into all aspects of the business or assets being sold. Selling companies can prepare for a transaction by collecting and organizing information about all aspects of its business (Figure 1). These include overviews of key business information, including feedstock strategy, compost marketing plans, market growth plans, permits and regulatory summaries, and other important information. Compiling three to five years of financial data is suggested.

Identify and Resolve Potential Transaction Issues: Beyond just gathering information, prospective sellers should pay careful attention to any issues or risks that might cause concern for an acquirer, whether in the structure of the company, the agreements with customers, or the intellectual property of the business, among other things. Intellectual property and insurance requirements may seem unnecessary to a small business but are deemed indispensable by larger companies. For instance, and as discussed in a prior BioCycle article, intellectual property protection of products and brand names is valued by larger companies. Additionally, environmental insurance is often not carried by smaller composters, but can be a benefit to larger companies and can help to protect selling companies from liabilities that arise after a transaction (see “5 Tips To Getting Best Environmental Insurance Policy”). Experienced advisors and legal counsel can assist with this preparation.

Sellers should also consider industry-wide issues and risks and prepare documentation to quantify the impact of those risks on the business. For instance, even if PFAS (per-fluoroalkyl compounds) are not a significant issue for an organics recycling business now, sellers should assess their impact on operations and prepare documentation to help the buyer come to a similar conclusion. Highlight positive tailwinds as well, such as local or state organics diversion policies, community or local government support, and strength of customer relationships.

Protect Information Before Sharing: Before any information is shared with a prospective buyer, the parties should execute nondisclosure and noncompetition agreements. Sellers also need to keep in mind that they do not need to disclose too much confidential information at the early stages of a transaction and should feel free to redact or retain information that would undermine their competitive advantage.

Securing a Buyer: There are sometimes many potential buyers, and selling companies should determine how to get as many bidders as possible to the table. Where possible, identify interested buyers and conduct a competitive bidding process. Potential buyers can be identified by working with experienced legal counsel or specialty business brokers, reviewing Waste Dive’s M&A tracker for similar transactions, and reaching out to your local industry groups. In addition to securing a higher valuation, this also allows sellers to control critical aspects of the transaction, such as the type (asset or stock transaction), timing, and other key terms.

At each stage, experienced professionals, including lawyers, accountants, and business consultants, can assist with preparing for an M&A transaction. Part II will discuss different transaction types, e.g., asset sales, stock sales, joint ventures, and some nuances associated with each.

Matthew A. Karmel, Esq. is chair of Offit Kurman’s Environmental and Sustainability Law Group, and provides comprehensive legal assistance to composters and other members of the organics recycling industry. He also helped found the NJ Composting Council and its Advocacy and Market Development Committee.