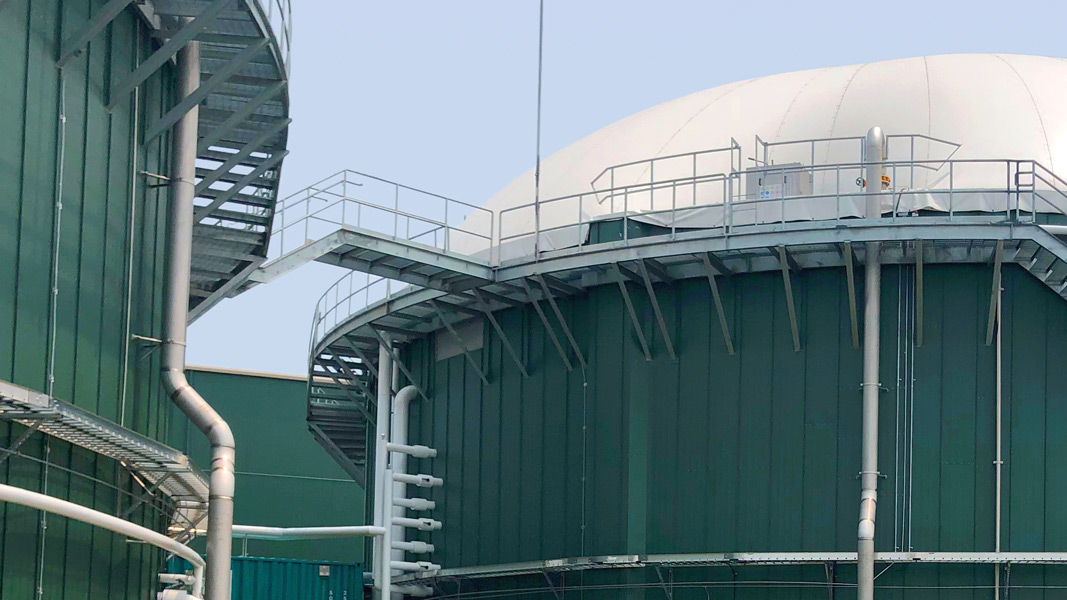

Top: Bioenergy Devco’s merchant food waste digester in Jessup, Maryland. Photo by Paul Greene

Congresswoman Hillary Scholten (D-MI) and Congressman David Valadao (R-CA) introduced the Agricultural Environmental Stewardship Act of 2025 to extend the Section 48 investment tax credit (ITC) for qualified biogas properties. The Inflation Reduction Act (IRA; P.L. 117-169) extended the Sec. 48 ITC through December 31, 2024, to support the deployment of certain clean energy technologies, including anaerobic digesters. The ITC offers a significant tax credit — up to 30% of qualified development costs, provided certain requirements are met, such as prevailing wage and apprenticeship requirements. However, the Department of Treasury’s final rulemaking was not released until December 4, 2024 — 27 days before the expiration of the tax credit. To boost domestic clean energy production, the bipartisan legislation aims to extend the Sec. 48 ITC for qualified biogas properties through December 31, 2025, enabling innovative biogas producers to make major clean energy investments with the regulatory certainty provided through the Treasury’s final rulemaking. This bipartisan effort will “catalyze our nation’s clean and alternative fuel production from landfills, wastewater treatment plants, diverted food waste, and agricultural operations to slash greenhouse gas emissions and save consumers money,” stated the press release. “Extending the Sec. 48 ITC is common sense,” said Scholten. “If we want to secure America’s green future, we must ensure that producers have the clarity necessary to make critical investments in biogas.”