Top: Between groceries and restaurant plate waste, consumers spent $261 billion on food they didn’t ultimately eat. Photo by Sally Brown

Nora Goldstein

ReFED, a U.S.-based nonprofit that works to advance solutions to food waste, released From Surplus to Solutions: 2025 ReFED U.S. Food Waste Report in late February, featuring the latest data on the progress, trends, and remaining challenges in reducing food loss and waste in the United States. The report outlines that while there has been significant momentum in preventing and reducing food from going to waste — and the foundation for progress has been laid — waste remains stubbornly high. As such, “accelerated action is needed from all food system actors, from funders to food businesses to solution providers to policymakers, to reduce food loss and waste,” says Dana Gunders’ ReFED’s president. “We’re still far off from meeting the national 2030 food loss and waste reduction target, and unless the pace of action picks up, we’re not going to come close. I think readers of the report will walk away with a sense that change is possible, but we need to get to work.” This article is based on excerpts from the 2025 U.S. Food Waste Report.

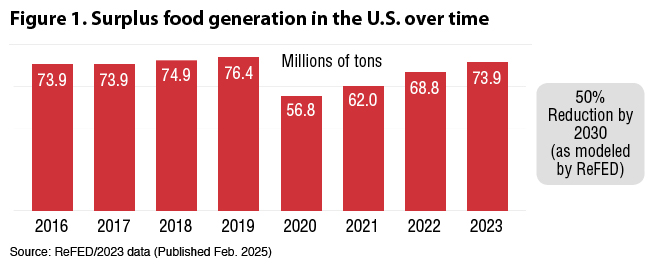

ReFED categorizes quantities of unsold or uneaten food as “surplus food.” Its data shows that after a dip during the COVID-19 pandemic, surplus food rebounded in 2023 to an alarming 73.9 million tons or 31% of the food supply at a value of $382 billion or 1.4% of U.S. GDP, or gross domestic product (Figure 1). Some of this total value was food that might have been sold by farms, manufacturers, retailers, and foodservice operators but wasn’t. If it had been sold, an additional 5% of annual food spending could have been realized as revenue. Between groceries and restaurant plate waste, consumers spent $261 billion on food they didn’t ultimately eat, which represented nearly 14% of their annual food-at-home spending and 7% of food-away-from-home spending. Figure 2 shows where surplus food comes from, why it is wasted or lost, and the types of food that aren’t getting eaten, using data from 2023.

The analysis indicates that surplus food is responsible for 4% of U.S. greenhouse gas emissions (GHG), the same as driving 54 million cars, or 18% of all registered vehicles in the country. “Surplus food also has an outsized impact on natural resources, including water and land,” states the report. “It accounts for 16% of U.S. freshwater withdrawals, enough for every American to shower seven times a day all year. If all surplus food were grown in the same place, it would require 140 million acres of land — an area the size of California and New York combined.”

ReFED’s analysis uses the social cost of carbon (SCC) estimates from the U.S. EPA and its own data on the extent and impacts of food waste to show that the global social cost of emissions from food waste for the single year of 2023 was $47 billion. “Since GHG emissions from a single year persist in the atmosphere over time and continue to have impacts, the cost of annual emissions compounds and actually increases annually as well — so 2023 emissions from surplus food will ultimately reach a cumulative cost of more than $571 billion over 10 years,” according to the analysis.

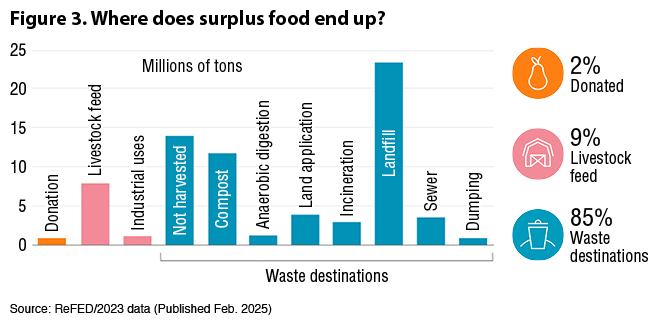

Of the surplus food generated, 85% goes to waste destinations, 9% goes to livestock feed, and 2% is donated. As seen in Figure 3, the vast majority ends up in the landfill.

Top Generators: Consumers

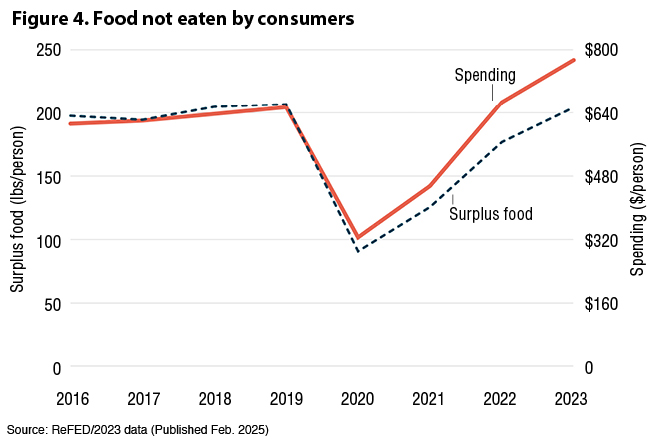

Even with increasing food costs, consumers continue to generate the largest amount of waste. Between uneaten groceries at home and restaurant plate waste, consumers waste close to 35 million tons of food annually, or nearly $800/person (Figure 4).

For the purposes of the 2025 U.S. Food Waste Report, restaurant plate waste is counted in what ReFED is now defining as “consumer” waste, and not counting it as foodservice waste. However, in ReFED’s Insights Engine data tracker, plate waste is still included in the foodservice bucket. “The idea in the report was to explore a new way to slice and dice, particularly since we wanted to highlight the amount of food waste attributable to consumers in total, in the face of rising food prices and the expectation that this would lead to less waste — although it actually doesn’t seem to be,” says Minnie Ringland, ReFED’s Climate & Insights Manager and a lead researcher and author of the report.

For surplus generated at home, ReFED updated how it estimates household food waste in its Insight Engine, using newly available research that enables measurement over time versus a static data point in time. “Previously, ReFED estimated the amount of food waste generated by the residential sector using consumer loss rates from the U.S. Department of Agriculture’s Loss-Adjusted Food Availability (LAFA) Data Series,” explain the report’s authors. “This comprehensive dataset covers over 200 commodities and is based on years of expert research. However, the most recent data available, from 2011-2012, does not reflect recent research or changes in consumer food waste behavior over time.”

To capture these changes ReFED is using data from household food waste research conducted by Ohio State University Professor Brian Roe. This research is part of a collaborative effort between the Ohio State Food Waste Collaborative and the Multiscale RECIPES Sustainable Regional Systems Research Network. Since 2021, Roe has conducted surveys about household food waste three times a year, providing a uniquely consistent and up-to-date dataset that ReFED now uses as the basis for estimating consumer household waste across the United States.

“To validate the accuracy of these new estimates, we verified them against a systematic review of waste characterization studies conducted in over 20 states during the past 20 years, which provides a rough baseline for household food waste in landfills,” explains ReFED. “Since the survey data begins in 2021, we backfilled 2016 to 2019 estimates using 2023 waste rates, based on the assumption that recent waste behavior is similar to pre-pandemic consumer behavior. Since ReFED’s previous estimates likely overestimated the amount of food consumers actually throw out at home, this methodological change provides a more accurate and real-time understanding of the country’s food waste landscape. With these up-to-date waste rates, ReFED’s overall estimate of residential waste is lower by 40% or 17 million tons, for 2023. This does not mean dramatic progress has been made to reduce food waste in the residential sector. In fact, these estimates show that consumers still generate the most food waste in the entire food system — furthermore, consumer waste rates are actually increasing.” Details about the methodological changes are available on the ReFED Insights Engine methodology webpages.

Food Businesses

While food businesses generate 21.5 million tons of surplus food annually, equating to $108 billion in lost revenue, momentum to address waste is building, with 20% of the top 65 food businesses across foodservice, retail, and manufacturing having specific, time-bound food waste reduction targets. The value of surplus food among consumer-facing businesses (retail, full and limited-service restaurants and other foodservice) is $65.7 billion; food manufacturing is $41.9 billion.

More businesses are reporting on food loss and waste due to regulatory requirements and investor pressure. Those in the lead are leaning into decision-ready data that goes beyond public reporting and informs their strategic plans for food waste reduction, according to ReFED, noting that “when it comes to addressing waste, leading businesses have often already tackled the ‘low-hanging fruit.’ They are now leveling up to address more complex issues, which require coordination and partnership across the supply chain, and collaboration with their industry peers and competitors. Employee education and engagement programs are driving real results. Pilot programs that put employees in charge of identifying the most significant issues and recommending solutions to implement are seeing waste reductions of 50-70% at those points of impact.”

Food Loss And Waste Solutions Investment

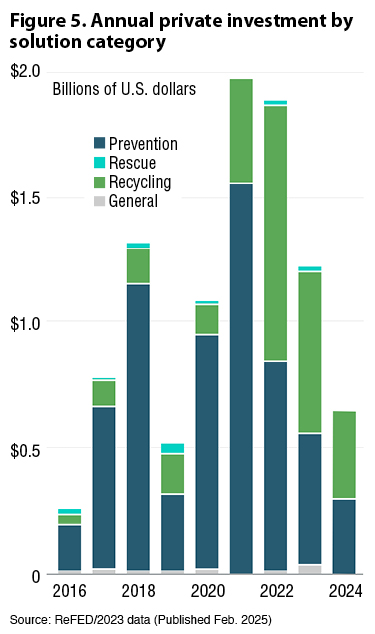

More than $900 million was invested in food loss and waste solutions in the United States in 2024 by public, private, and philanthropic sources. However, despite the significant environmental impact of food loss and waste, only 4% of the $600 billion in global annual investment for climate mitigation and adaptation goes to food and agriculture generally, with an even smaller portion funding food waste initiatives, says the report. Figure 5 shows annual private investment by solution category from 2016 to 2024.

“A $16 billion annual investment over a 10-year period in the 45 food waste solutions that ReFED has modeled could create a net financial benefit of $60.8 billion — a 3.8x return — while diverting 20 million tons of surplus food from the landfill and avoiding 79 million metric tons of carbon dioxide equivalent,” explains Dana Gunders. Investor funding over the last few years has focused on supply chain technologies, including inventory management, waste tracking (usually AI-enabled), and shelf-life extension, as well as end-of-life waste destinations like kitchen waste storage and infrastructure-based waste management (e.g., anaerobic digestion, insect farming).

The 2025 U.S. Food Waste Report also covers key trends in solution development and adoption, research highlights, and the policy landscape. In terms of an overall 2025 Outlook, says ReFED, “broader trends will set the stage for food waste reduction, some factors driving less waste as an ancillary benefit and others perhaps causing more. There are also specific initiatives that will take root to drive progress. Overall, we’re in a ‘food waste moment,’ where external factors are aligning to make it an opportune time to make real progress on food waste reduction.”