BioCycle June 2018

Wellesley, Massachusetts: Growth Projected For Biogas Market

A global focus on renewable energies and increasing environmental regulations aimed at greenhouse gases are helping to drive the waste-derived biogas market, according to a report by BCC Research. “The industry is expected to see a compound annual growth rate (CAGR) of 10.6 percent through 2022, when it could be worth $10.1 billion,” according to the BCC report, Waste-derived Biogas: Global Markets for Anaerobic Digestion Equipment. “Wastewater/sludge and industrial applications will lead the market in growth, with a CAGR through 2022 of 11.4 percent, although landfill gas, agriculture, and food and municipal wastes will lead by size, with a 2022 value of $5.8 billion. In North America, passive biogas production system growth will be led by Mexico, which anticipates a CAGR of 8.4 percent through 2022, though the United States will lead the regional market by size, with a 2022 value of $65.9 million.”

Although regulations are not the sole driver of the biogas industry, says BCC, they are a primary one. In Europe, home to the world’s largest regional anaerobic digester market, the “existence, stability and reliability of the legal and political framework is seen as the greatest influence on the market,” notes the report. “Germany’s rise to become a market leader came after the passage of major renewable energy legislation, and in the United Kingdom, the passage of a renewables obligation law provided the framework for a developing anaerobic digestion market.”

Philadelphia, Pennsylvania: AD Facilities Processing Food Waste In U.S.

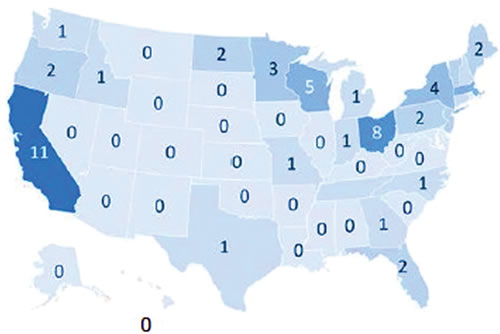

A report released in May 2018, Anaerobic Digestion Facilities Processing Food Waste in the United States in 2015, presents results of an EPA survey (conducted in 2017) of U.S. operators of anaerobic digestion (AD) facilities that accept food waste. The project goal is to identify the number of these types of AD facilities and their locations, and to learn about their operations, including all feedstocks processed, biogas production and digestate management. Authored by Melissa Pennington, Sustainability Coordinator at EPA Region 3 in Philadelphia, PA (who also conducted the survey), this report is the first of several annual data collections EPA will make through 2019. It covers data for calendar year 2015 and summarizes data received for three types of AD facilities: Stand-alone food waste digesters; On-farm digesters that codigest food waste; and Digesters at water resource recovery facilities (WRRFs) that codigest food waste. Future reports will summarize data for 2016, 2017, and 2018.

A report released in May 2018, Anaerobic Digestion Facilities Processing Food Waste in the United States in 2015, presents results of an EPA survey (conducted in 2017) of U.S. operators of anaerobic digestion (AD) facilities that accept food waste. The project goal is to identify the number of these types of AD facilities and their locations, and to learn about their operations, including all feedstocks processed, biogas production and digestate management. Authored by Melissa Pennington, Sustainability Coordinator at EPA Region 3 in Philadelphia, PA (who also conducted the survey), this report is the first of several annual data collections EPA will make through 2019. It covers data for calendar year 2015 and summarizes data received for three types of AD facilities: Stand-alone food waste digesters; On-farm digesters that codigest food waste; and Digesters at water resource recovery facilities (WRRFs) that codigest food waste. Future reports will summarize data for 2016, 2017, and 2018.

The following are a few of the findings:

• EPA confirmed that 154 AD facilities processing food waste were operational. Another 30 facilities are believed to be operational, bringing the total operational (confirmed plus unconfirmed) to 184. Surveys were returned by 137 of the 184 total operational facilities.

• Total processing capacity for food waste and food-based materials in all three digester types in 2015 (137 reporting) was 15.8 million tons/year; the total amount of food waste processed in all three digester types was 12.7 million tons.

• Total amount of biogas produced at digesters in 2015 (by 137 AD facilities processing food waste) was 358,742 standard cubic feet per minute (SCFM), equivalent to 1,117 MW installed capacity, 8.361 billion kWh/year, or enough energy to power 684,639 homes for a year.

• Top use of biogas among all three digester types was to produce heat and electricity (CHP).

Appendices to the report include the survey questions for each category of digesters and lists of facilities surveyed regarding use of food waste and food-based materials as a feedstock. All locations were identified using publicly available information.

Jessup, Maryland: Food Waste Digester Update

The Maryland Food Center Authority (MFCA) owns and operates the Maryland Wholesale Seafood Market and the Maryland Wholesale Produce Market, a 400-acre area in Jessup with about 50 produce and seafood merchants, food processors and distributors and other businesses. In 2017, MFCA leased property to BTS Bioenergy to construct and operate a 100,000 tons/year food waste digester that would service the wholesale markets as well as other generators in the area. Under the terms of its lease with BTS, the company will not pay rent the first year while obtaining permits. In the second year, it will start paying $11,044 monthly. “The Maryland State Board of Public Works approved the lease in February, and BTS is now seeking permits from Howard County to build the facility,” explains Donald Darnall, Executive Director of MFCA. “We’ve been working closely with BTS to identify sources of food waste for the facility and help engage the generators.”

A groundbreaking for the digester was held May 14. That same day, the Maryland Energy Administration announced that BTS Bioenergy is receiving a $500,000 grant to install a 1.4 MW Combined Heat and Power (CHP) system. The project also is evaluating production of renewable natural gas that could be injected into a natural gas pipeline that traverses the site.

State College, Pennsylvania: Phosphorus Removal Technology

A team of researchers from Pennsylvania State University and the U.S. Department of Agriculture’s Agricultural Research Service developed a system capable of removing almost all phosphorus from stored livestock manure. Dubbed MAPHEX for MAnure PHosphorus Extraction, the system utilizes a three-stage process that includes liquid-solid separation with an auger press and centrifuge; chemical treatment with the addition of iron sulfate; and final filtration with diatomaceous earth. The machine is designed to process manure from manure-storage tanks or pits on dairy farms. When tested at 150 and 2,700 cow dairies, about 98 percent of the phosphorus was removed from manure slurries, along with 93 percent of the solids. As currently configured, the MAPHEX system would cost approximately $750/dairy cow/year for a dairy operation.

Research on the MAPHEX system was conducted in central Pennsylvania, part of the Chesapeake Bay Watershed and an area with an intense focus on developing treatment systems for manure. In 2010, manure from the dairy sector was estimated to account for 20 percent of all phosphorus in the Chesapeake Bay watershed. MAPHEX is designed to be a mobile system that fits on two large flatbed trailers to service a number of small- or medium-size dairies. It would no longer be mobile if scaled up to have the capacity to treat manure from a large dairy.

Goulburn, Queensland, Australia: Abbatoir Self-Powering With Biogas

A Goulburn abattoir has teamed up with a Queensland energy provider to turn its waste into energy, using funding from the Australian Renewable Energy Agency (ARENA). ARENA provided $2.1 million in funding to ReNu Energy in 2017 to design, construct, own and operate a biogas facility at Southern Meats’ abattoir facility, which processes sheep and lambs, using around 20,000 kWh of electricity daily.

The $5.75 million project consists of an anaerobic digestion process where the abattoir waste is treated in a covered lagoon to produce biogas. Biogas is conditioned and transferred to two 800 kW dual fuel generators to produce approximately 3,800 MWh/year of electricity for use during the manufacturing process to reduce peak electricity consumption during peak charge periods. The lagoon acts like a giant bladder that can expand to hold biogas when energy demand is low, saving it to generate power during peak usage. The generators are able to supplement biogas with natural gas.

London, England: New Tariffs Boost UK Biomethane Industry

The United Kingdom’s green gas (biomethane) industry has described the restoring of higher tariff levels for the Renewable Heat Incentive (RHI) as a “vital boost” to the UK’s ability to produce renewable green gas for heating homes and businesses through anaerobic digestion (AD). Following passage of the relevant legislation through Parliament, beginning on May 22, 2018, new AD plant operators can claim a restored tariff of 5.6p ($0.08) per kWh of renewable heat generated for their Tier 1 biomethane (the first 40,000 megawatt-hours they inject into the grid per year). Once their plant is commissioned, they will receive a guaranteed tariff level for 20 years.

Deployment of new biomethane plants in the UK has been falling in recent years in line with decreases in RHI tariff levels. The biomethane industry is now forecasting that as many as 40 plants may be built over the next two years as a result of the restored tariff levels, generating up to an additional 2 terawatt-hours (TWh)/year of renewable heat. The biomethane industry in the UK is currently contributing over 4 TWh/year of gas, but with the right support it has the potential to meet around 15 percent of total UK gas consumption, and heat 30 percent of UK households. The restored RHI tariff, however, will only support new renewable heat projects until 2021, with no further support promised from government beyond the current RHI budget allocation.