Nora Goldstein

“Digesting Dumped Dairy.” That was the title of an April 15 webinar hosted by the American Biogas Council (ABC), which featured Steve Dvorak, DVO, Inc., Craig Frear, Regenis, Bernie Sheff, Montrose Environmental, Bryan Sievers, AgriReNew/Sievers Family Farm and Patrick Serfass, ABC. The presenters addressed a range of topics that included:

• Why are dairies dumping milk?

• How does milk change digester chemistry and biology?

• Operational challenges and anaerobic digestion system optimization

• Latest news on the consequences of digesting milk on D3/D5 RINs categorization

Steve Dvorak provided the latest news on “dumped dairy,” citing statistics from various news sources. For example, according to the Wall Street Journal, during the first week of April, 7% of U.S. milk produced was dumped. The Journal was citing data from the Dairy Farmers of America (DFA), the largest dairy cooperative in the U.S. DFA reported that farmers have been dumping 3.7 million gallons of milk/day.

The “dumping” of milk, noted Dvorak, results directly from the COVID-19 quarantine dramatically changing the way milk is consumed and the type of processed milk products needed. For example, processing plants that serve the foodservice market cut back production or closed, said Dvorak, “due to large institutional buyers of milk — restaurants, hotels, schools, universities, etc. — shuttered abruptly. In turn, they abruptly cancelled large orders with foodservice milk and cheese plants. U.S. cheese sales are down 70% in large part because roughly half of butter and half of cheese produced in the U.S. is sold to restaurants.”

He also addressed a very common question: Why are farmers dumping milk when refrigerated grocery cases are often empty? Dvorak walked webinar attendees through the new realities:

• Processing plants that serve the retail/grocery store market are at capacity

• Grocery store milk sales up 30% in March

• Dairy is perishable, so retail fluid processors can only hold so much in inventory — and they’re at capacity

• Lack of appropriate-size dairy packaging to shift production to meet surge in retail/grocery store demand

“Plants that generally serve the foodservice/restaurant markets don’t have the packaging needed to sell products where current demand is — grocery stores,” said Dvorak. “Fluid milk plants need one-gallon and half-gallon containers. Butter and cheese milk plants need smaller, retail-size butter and cheese packaging. These companies don’t have the equipment to pivot to where the demand is. That involves switching a relatively old industry to a completely different market.”

Other factors contributing to the excess milk are loss of export sales; lack of employees to process milk due to COVID-19 concerns or illness; lack of transportation to the retailer; difficulty in donating milk to food banks (as it still needs to be processed and stored); and many states prohibit farmers from selling milk directly to the public.

Can’t “Turn Off” The Source — Assessing The AD Option

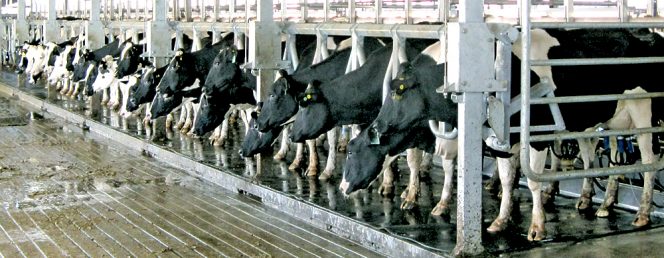

Underlying all of the “infrastructure” challenges is the fundamental reality: You cannot stop milking the cows to reduce the amount of milk being produced. The milk keeps coming; dairies typically milk their cows three times a day. Short of selling their herds and going out of business, dairy farmers have limited options, starting with the reality that field spreading of milk produces strong odors, and farmers have to factor in the impacts to BOD, COD (biological and chemical oxygen demand) and nutrient loadings. Furthermore, most states prohibit spreading on frozen fields, and in some regions, fields are just beginning to thaw. The last hurdle? Adding the milk to a dairy farm’s lagoon at this time of the year — when lagoons have been used all winter to store manure — is a limited option.

At this point, the webinar shifted to the option of diverting excess milk to anaerobic digesters. The pluses to the digester operator include increased biogas production for more electricity/RNG (if capacity available); a decrease in BOD and COD; and destruction of odors and pathogens. “The additional biogas means there is some value for it as a codigestion substrate with dairy manure,” said Dvorak.

Craig Frear and Bernie Sheff reviewed the biological and chemical realities of “digesting dumped milk,” starting with a few fundamentals:

• Waste dairy milk and other dairy by-products can be effective substrates for codigestion with dairy manure.

• The biomethane potential (BMP) of raw dairy milk, measured in methane (CH4)/volatile solids (VS), is reported to be 0.512 m3CH4/kg VS or 8.2 ft3CH4/lb. VS (Lunda-deRisco et al, 2011).

• The high production capability of CH4 is due to milk being primarily composed of sugars that are readily digested and converted by the microorganisms.

Although readily digested, “raw milk can quickly sour an anaerobic digester due to product inhibition — when the first steps of the AD process progress so quickly that acid builds up too fast for the latter steps to effectively proceed,” explained Frear. “This can lower the pH and inhibit the bacteria, particularly the sensitive methanogens. This situation causes the digester to become ill and decrease its biogas production.” (The 4 steps of anaerobic digestion are: 1) Hydrolysis; 2) Acidogenesis; 3) Acetogenisis; and 4) Methanogenisis.)

Best Practices For Codigesting Milk

Given those realities, what are the best management practices for codigesting milk with dairy manure? Frear and Sheff offered the following:

• Codigestion has its limits. Research by Wu et al (2011) shows inhibition at 19% volumetric milk with manure — under perfect conditions in the laboratory.

• Codigestion will produce higher levels of carbon dioxide, lowering the overall methane percentage, which can be detrimental to downstream processes.

• Digester heating needs will increase: A 6,000 gallon load of waste milk at 60°F needs 40°F x 6000 gal. x 8.34 lb./gal. x 1 BTU/lb./degree F. That equals 2,001,600 BTU or an additional 2 MMBTU of heat. “When efficiencies are considered, the amount of additional heat to be generated is more likely 2.4 MMBTU,” explained Sheff.

• A dairy digester with capacity to receive 6,000 gal/day of milk typically services a dairy with 2,000 cows.

• An increase of >10% in the organic loading rate (OLR) is discouraged. Whole milk is generally 12% total solids (TS), 90% VS with a biomethane potential of 8.2 ft3CH4/lb. VS and 63% CH4.

• The 6,000-gallon load will add 5,404 lbs. of VS (6000 x 8.34 x 0.12 x 0.9) that must be considered in the OLR of the digester.

• The addition of the milk may reduce the detention time to the extent that time for digestion is reduced.

• Mixing in the digester may be impacted if the amount of milk drops the solids content to a point that solids are no longer suspended. Therefore mixing time may need to be increased if the milk reduces the solids content appreciably.

Some type of storage, such as an unused tanker truck, is necessary in order to gradually dose the milk in with the manure each day. “The bottom line is that manure digesters can effectively add and digest milk,” said Frear. “The key is to start low, and dose and mix it in as best you can. Watch the pH and the gas concentration, and do testing.”

Impact On D3 RINs

Brian Sievers and Patrick Serfass, ABC’s executive director, addressed the question of whether accepting milk into a manure-only digester will disqualify the RINs sold vis-à-vis EPA’s Renewable Fuel Standard (RFS) as D3 RINs. RINs categorizations are based on cellulosic content, and manure has a higher cellulosic content than food waste; milk “waste” is considered a food waste, which has a D5 RINs designation. The price differential of D3 vs D5 RINs is substantial. In EcoEngineer’s daily RINs report on April 17, 2020, the closing value of D3 RINs was $1.010/RIN; D5 RINs were trading at $0.513/RIN.

ABC has asked EPA to make a temporary allowance for digesters processing manure only to accept milk and not have it jeopardize their D3 RINs status. “EPA is still using a very conservative interpretation of the RFS rule and its RINs categories,” said Serfass. “We will continue to press the agency to make this allowance, and will keep ABC members apprised.”

The recording of the April 15 webinar, “Digesting Dumped Dairy,” is available to ABC members. To learn more, email info@americanbiogascouncil.org.

Big News From Washington State

The Seattle-Tacoma International Airport (informally known as Sea-Tac) is ready to run on renewable natural gas (RNG), according to the Port of Seattle Commission. The Commission, which operates Sea-Tac, approved a $23 million contract to enable the Port to reach its 2030 goal to reduce carbon emissions by 50 percent, almost a decade early. The contract enables the Port to purchase enough RNG fuel to heat 55 percent of the Sea-Tac terminal and to power 100 percent of its bus fleet at the airport to reach its 50 percent port-wide carbon reduction goal.

Sea-Tac will be the first airport in the country to utilize RNG for heating. The fuel delivery begins October 1, 2020. The RNG-related cost increase to the airline rates is less than one percent. There are no costs to terminal tenants such as Airport Dining and Retail operators or to taxpayers.

This long-sought major milestone, voted on at the Commission meeting on April 14, 2020, results from authorization for a 10-year supply contract with U.S. Gain for Renewable Natural Gas (RNG), a low-carbon natural gas alternative produced at landfills with gas capture systems, and anaerobic digestion facilities. RNG produces no new carbon emissions because it replaces fossil fuels and recycles existing carbon in the atmosphere, noted the Port in an April 15 press release.

Natural gas accounts for 75 percent of the Port’s annual climate-warming greenhouse gas emissions. The contract with U.S. Gain will result in the reduction of approximately 11,000 tons of emissions the Port directly produces from its own operations (scope 1) and those from the energy it purchases (scope 2). This reduction is equivalent to heating 4,000 Seattle homes or taking 2,400 passenger vehicles off the roads each year of the contract.

The Port’s RNG supply comes from a landfill outside Washington state as most large in-state landfills already capture and sell their RNG either as electricity or transportation fuel to California markets. California state legislation provides price incentives for low carbon fuels, making it more lucrative for renewable fuel providers (see “101 For Low Carbon Fuel Standard”).

For the past three years, the Port has strongly supported legislation creating a statewide Clean Fuel Standard for Washington, which would create incentives for new businesses to produce these fuels for use in Washington. The Port utilized RNG in 2014 and 2015, but the supply was transferred out of state due to financial incentives offered in California. Once Washington creates a clean fuel standard, the Port will no longer pay a premium for RNG or other renewable fuels used for transportation, notes the April 15 press release.