Editor’s Note: This article is based on excerpts from The Economic Contribution of the Australian Organics Recycling Industry (March 2020), aora.org.au.

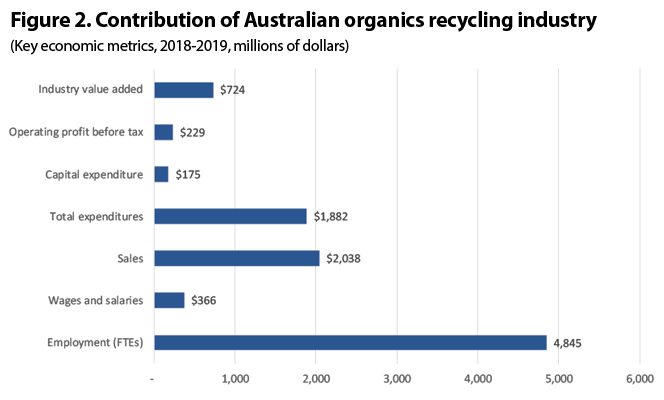

A new economic benefits analysis of the organics recycling industry in Australia, The Economic Contribution of the Australian Organics Recycling Industry (March 2020), identified 305 businesses operating in the sector that recycled and processed 7.5 million metric tons (8.3 million tons) of organic material in 2018-19 with collective industry turnover of more than $2 billion (includes revenue, investment, and expenditures). These enterprises created 4,845 jobs, paying over $366 million in wages and salaries.

The country produced a total of 14.6 million metric tons (MT) of organic waste. In addition to the 7.5 million MT recycled, 5.6 million MT were landfilled, and 1.5 million MT were recovered through waste-to-energy. Australia’s overall organic material recycling rate was 51.5%; the recovered rate was 61.9%. By region, New South Wales accounts for the largest tonnage of organic material recycled in Australia at present (2.8 million MT or 36.7% of total) in 2018-19. Victoria is the next largest (1.5 million MT or 19.8%) followed by South Australia (1.3 million MT or 16.8%), and Queensland (1.1 million MT or 14.9%).

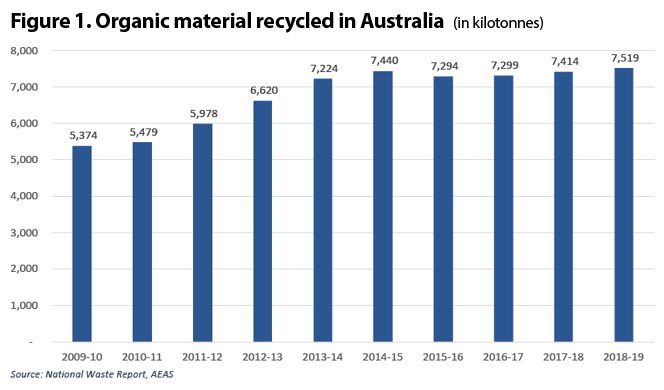

The economic benefits study was commissioned by the Australian Organics Recycling Association (AORA) and conducted by Australian Economic Advocacy Solutions (AEAS), an economic analysis, research and advocacy service in Australia. The goal was to determine the economic benefit of the Australian Organics Recycling Industry (AORI) to the Australian and all state economies. The analysis looked at the decade from 2009-10 to 20018-19, and found that AORI’s recycled tonnage grew by 3.4% annually (Figure 1), with Australia’s average population growth rate of 1.4% across the same time. The noticeably higher growth rate for organic material recycled has been driven by both population and economic growth but is also a reflection of technological change, access to recycling markets, local government collection changes, and both Commonwealth and State Government waste and carbon reduction policies.

The analysis looked at the decade from 2009-10 to 20018-19, and found that AORI’s recycled tonnage grew by 3.4% annually (Figure 1), with Australia’s average population growth rate of 1.4% across the same time. The noticeably higher growth rate for organic material recycled has been driven by both population and economic growth but is also a reflection of technological change, access to recycling markets, local government collection changes, and both Commonwealth and State Government waste and carbon reduction policies.

Garden organics make up the largest portion of organic materials recycled nationally —41.6 percent — followed by biosolids (18.8%), timber (13.7%) and food organics (7.2%). This equates to 298 kilograms (657 lbs) of recycled organic material for each person in Australia. Other direct economic benefits resulting from AEAS’s macro-economic analysis include:

Other direct economic benefits resulting from AEAS’s macro-economic analysis include:

- The collective industry turnover of over $2 billion; sourcing $1.9 billion across its supply chain, investing $175 million in land, buildings, plant and equipment and vehicles each year and contributing $724 million in industry value added to the Australian economy (Figure 2).

- Average livelihood to each employee within the industry of $75,540, which compares to Australian average weekly earnings of $64,390. In addition, $35 million is paid towards employee superannuation (pension).

- Sources and provides $1.9 billion in benefit across its supply chain.

- $175 million investment in land, buildings, plant and equipment and vehicles each year.

- $724 million in industry value added to the Australian economy.

Indirect economic benefit contributed by AORI include $579 million in industry value added to GDP (gross domestic product) through flow-on demand for goods and services, including production induced and consumption induced effects; and 4,070 indirect jobs provided through flow on activity.

Other key economic statistics include:

- One job supported for every 1,550 MT (1,700 tons) of organic material recycled in Australia

- Average sales/organics recycling business is $6.7 million. Expressed alternatively, total AORI turnover is estimated at $271/MT of recycled organic material

- Supply chain expenditure is estimated at $250/MT of recycled organic material

The total estimated greenhouse gas (GHG) savings from organics recycling in Australia in 2018-19 is approximately 3.8 million MT of CO2-e. These GHG savings are considered equivalent to 5.7 million trees that would have to be planted to absorb the same amount of CO2 or the GHG emissions that 876,663 cars would produce in a year.

Organics Streams And End Markets

Turning windrows at Peats Soil & Garden Supplies in White Valley, South Australia. Photo courtesy of Peats Soil

The analysis defines recycled organics “as a generic term for a range of products manufactured from compostable organic materials (garden organics, food organics, residual wood and timber, biosolids and agricultural organics).” Two essentially distinct but related organics markets are: 1) the service market for waste stream removal and processing and 2) the product market for compost.

Sources of recycled organics:

- Municipal, including residential supply from “kerbside” collection and transfer station drop-off, as well as other council waste (including parks and garden maintenance)

- Commercial and industrial (C&I) waste produced from businesses as a by-product of commercial activities, e.g., timber residuals, food organics and a range of processing by-products (e.g., organic waste from abattoirs)

- Construction and demolition (C&D) waste from C&D activities. Within the recycled organics industry, this waste stream is largely timber residuals — offcuts from construction or timber products from demolition

Recycled organic products (2 general buckets):

- Uncomposted mulch products — essentially “raw” products including mulch for application on top of garden beds, and potting mix which is bagged for retail sale.

- Compost products of different “grades” that correspond to product maturity. For example, pasteurized products that have met pathogen and vector attraction reduction requirements but are neither stable nor mature — in contrast to “mature compost” that is fully stable in addition to being pasteurized. A range of products is then produced from compost products, which are essentially variants of compost, reflecting age and expected use.

Main uses for compost:

- Mulching for water conservation and weed control

- Soil conditioning to improve soil structure and water holding capacity

- Fertilizing to increase levels of nitrogen, phosphorus and potassium and micronutrients

- Other, including carbon storage and disease suppression

Five industry market segments in Australia:

- Urban amenity including residential and commercial landscaping, retail nursery, special projects such as highway slopes and roadsides

- Intensive agriculture including viticulture, vegetable production, fruit and orchards, turf production, nursery production and wholesaling

- Extensive agriculture such as pasture production (livestock including sheep, beef and dairy), broadacre cropping, and forestry

- Rehabilitation, e.g., for landfill cover, erosion stabilization, land reclamation, restoration, revegetation and rectification

- Environmental remediation of contaminated sites and soils, as well as water purification and biofiltration uses

If More Organics Were Recycled …

The Prominent Hill mine in South Australia has a workforce of about 1,000. Food scraps and other organics from the mine’s village dining room are collected in a BiobiN equipped with an aeration system. Materials are taken to a Peats Soil facility for composting. Photos courtesy of BiobiN and Peats Soil

As part of the economic benefits analysis, AEAS modeled what the economic and environmental contribution of AORI would be if the current organics recycling rate (51.5%) were increased under four different scenarios: to 70%, 80%, 90%, and 95%. The report provides a valuable breakdown of this assessment by percentage rate recycled. The results (all using the 51.5% rate achieved in 2018-19 as a baseline) are as follows:

- 70% Recycling Rate: Organics recycling businesses would generate an extra $771 million in sales, providing an additional $712 million in supply chain opportunity with an extra $274 million in industry value added to the Australian economy. Organics recycling businesses would create 1,834 extra jobs paying $139 million. An additional 1.4 million MT of GHG emissions would be saved.

- 80% Recycling Rate: Generate an extra $1.1 billion in sales, providing an additional $1 billion in supply chain opportunity with an extra $401 million in industry value added to the economy. An 80% rate results in 2,682 extra jobs paying $203 million. An extra 2.1 million MT of GHG would be saved.

- 90% Recycling Rate: Generate an extra $1.5 billion in sales providing an additional $1.4 billion in supply chain opportunity with an extra $542 million in industry value added to the economy. A 90% rate would create 3,624 extra jobs paying $274 million. An extra 2.8 million MT of GHG greenhouse gas emissions would be saved.

- 95% Recycling Rate: Generate an extra $1.7 billion in sales providing an additional $1.6 billion in supply chain opportunity with an extra $612 million in industry value added to the economy. A 95% rate results in 4,094 extra jobs paying $309 million. An extra 3.2 million MT of GHG emissions would be saved.