Because of an all-time high waiver credit value paired with strong advanced RIN prices, renewable natural gas could fetch $35/MMBtu in 2017.

Susan Olson

BioCycle February 2017

The RFS is a part of the Clean Air Act, specifically the Energy Independence and Security Act (EISA), which was congressionally enacted under the Bush administration in 2007. Refiners and importers of petroleum-based fuels are obligated parties under RFS, which requires a percentage of refined transportation fuels to be blended with renewable fuels. These obligated parties are regulated entities that must demonstrate compliance with the blending requirements.

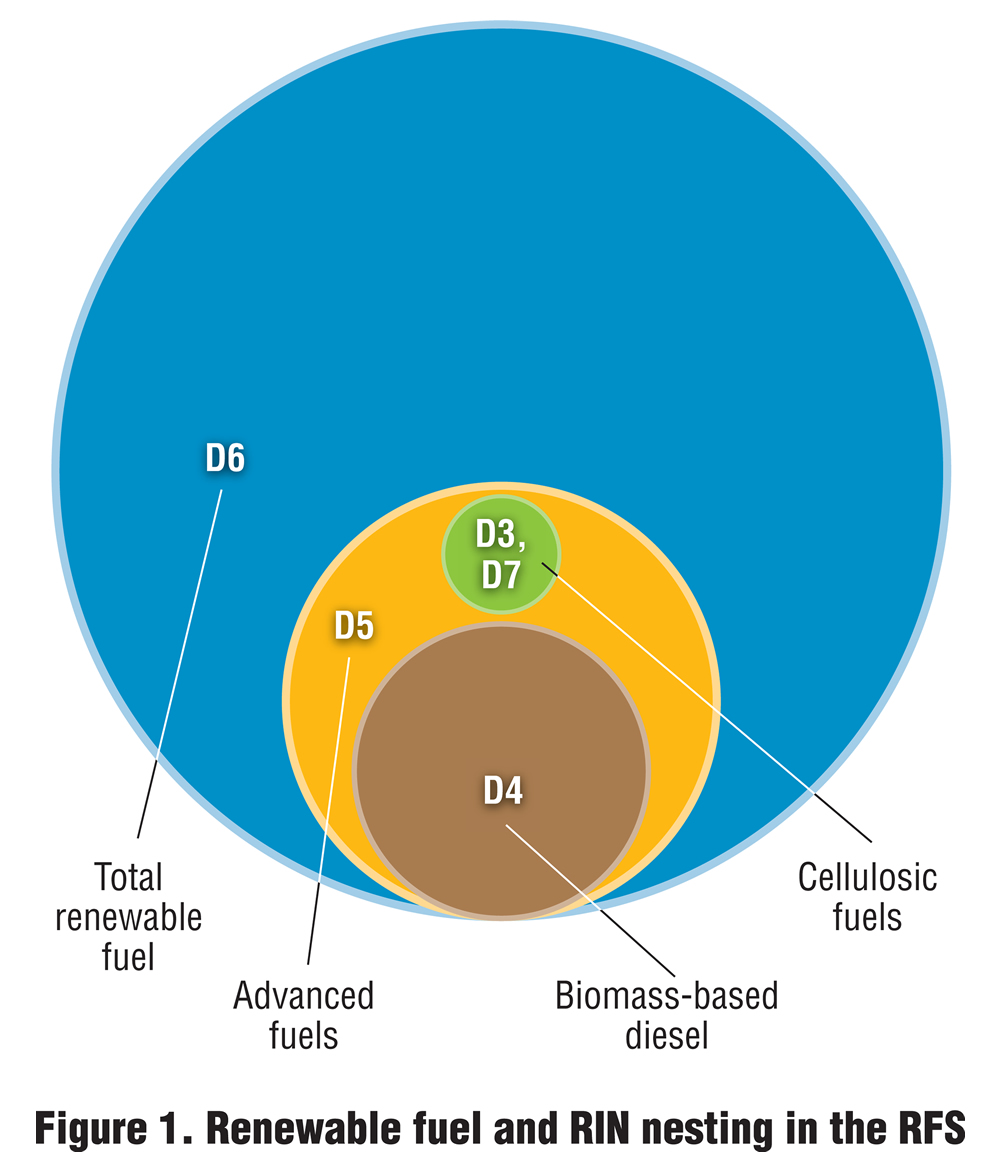

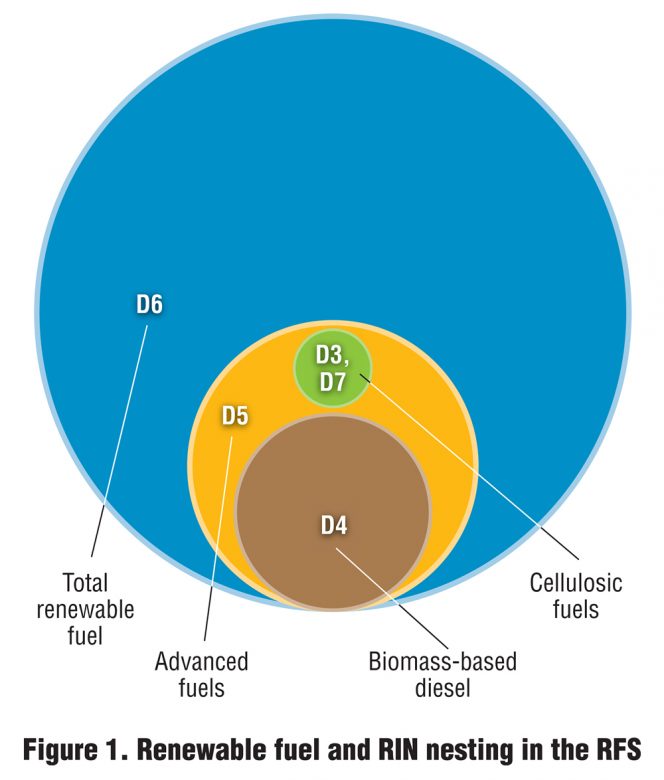

Each year, the EPA sets the renewable volume obligations (RVOs) for specific types of renewable fuels for obligated parties to meet. There is an overall renewable fuel RVO, and nested within that is a specific carve out for advanced biofuels as shown in Figure 1. Within that advanced biofuel RVO are further sub-requirements for volumes of biomass-based diesel and cellulosic-based biofuels.

Corn ethanol qualifies for D6 RIN generation, which may be used for the total renewable fuel mandate but not the advanced categories. Some refiners comply with the total renewable fuel mandate by blending ethanol with gasoline and retaining the RIN while others comply by purchasing separated RINs rather than blending. Some refiners use a mix of those activities.

The currency of RFS compliance is the Renewable Identification Number (RIN), which is a credit generated for one ethanol equivalent gallon of renewable fuel. RINs are generated by renewable fuel producers and importers based on production, import or sale of renewable fuels. RINs travel with the physical fuel until it is blended into the transportation supply. A RIN may then be retired by its obligated party owner, or separated and sold as its own environmental credit commodity, ultimately being purchased by an obligated party who needs it to prove that it is meeting its mandate. For 2017, the mandate for total renewable fuel is 15 billion gallons more than the advanced mandate. The 15 billion gallons will be fulfilled mostly by ethanol. There is a daily RIN trade although some days are more active than others.

Each RIN has its own code, called a D-code, based on the fuel type. These codes are listed below in order of decreasing RIN value:

• Cellulosic RINs are D3 or D7, the latter for cellulosic diesel

• Biomass-based diesel RINs are D4

• Advanced RINs are D5; D3, D4 and D7 RINs also qualify

• General renewable fuel RINs are D6, and all other RINs qualify

Under EISA, Congress envisioned that cellulosic fuels would eventually match the volumes of noncellulosic fuels through the development of cellulosic ethanol and cellulosic diesel. For a number of reasons, most liquid cellulosic fuels have faced both supply and demand challenges.

RNG For D3 RINS

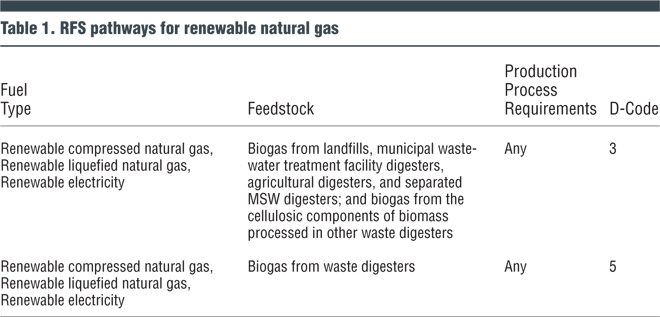

In 2014, RFS rule amendments designated CNG and LNG from landfill gas and certain types of digesters as cellulosic biofuel that qualifies for D3 RIN generation. Since that time, the cellulosic mandate has been met mostly by RNG. Table 1 lists the RFS pathways for RNG. Landfills have been the primary RNG suppliers over other sources because of the sheer economy of scale in return on investment from RNG collection and clean-up equipment.

Within the RFS structure, RNG can be displaced to CNG/LNG stations connected to the common carrier pipeline system. So RNG to transportation fuel under RFS is not just limited to landfills or digesters with CNG/LNG stations on-site. For displacement, the source must also be connected to a common carrier pipeline. RNG going onto the common carrier pipeline must be cleaned up to meet pipeline quality standards.

A series of regulatory registration, tracking and assurance mechanisms under RFS must be used to prove a one-to-one connection between the source and the sink. Participation in an EPA-approved Quality Assurance Program is an industry standard. Participation in the RFS program demands rigor, and the statutory requirements are not to be minimized. One anaerobic digestion facility that has gone through the process is Fair Oaks Farm in Fair Oaks, Indiana, which utilizes compressed RNG for its milk transport fleet.

Waiver Credit

The recent increasing economic incentive from the cellulosic RIN value has prompted new market participants to consider producing RNG for CNG/LNG use. This is the purpose of the RFS program — to promote renewable fuel production and use. The value of the cellulosic RIN is benchmarked to the value of an advanced RIN and the value of what is called a cellulosic waiver credit. The waiver credit warrants some further explanation:

Even with many biogas-based fuels qualifying for the cellulosic mandate, the current supply of cellulosic fuels still falls well short of the original EISA targets — primarily because the mandate outsizes the available supply. When the volume standards were set forth in EISA, it was expected that by 2022, more cellulosic liquid fuels (16 billion gallons) would be blended than conventional biofuels (15 billion gallons). Because of the reality that 16 billion gallons won’t be produced, the EPA has invoked its cellulosic waiver authority, which allows the cellulosic RVO to be lowered below the congressionally mandated cellulosic volumes in EISA. Any time this waiver authority is invoked, an obligated party has two options for satisfying its cellulosic mandate: 1) Purchase and retire D3 or D7 RINs; or 2) Purchase an advanced RIN and pair it with a cellulosic waiver credit.

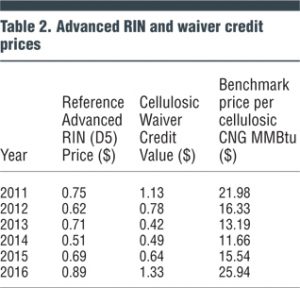

Cellulosic waiver credits are not commoditized credits. They are issued by the EPA directly to the requesting obligated party. The value of the waiver credit is set each year for the next calendar year according to a statutory formula, which is inversely proportional to the price of wholesale gasoline and directly proportional to the increase in the consumer price index since 2009. A table of the cellulosic waiver credit price with an estimation of annual average advanced RIN price is shown in Table 2. The combination of the RIN price and the waiver credit value effectively sets an upper benchmark for the D3 RIN market price, which is typically slightly below that combined value.

Table 2 also shows the value per MMBtu for CNG from transportation fuel based on the equivalence value of 11.7 RINs/MMBtu. It is understandable why the RIN value has sparked increased interest in developing new RNG facilities. The 2016 RIN price at the writing of this article was significantly higher than the average over the year at $1.04. The waiver credit price is $2.00 for 2017, the highest ever in RFS history. Even without an advanced RIN, this equates to $23.40/MMBtu.

Market Volatility

A word of caution is offered about the RIN market — it can be volatile. The RIN market is strictly an over-the-counter market settled by the cash price the market bears. A few futures options have been created over time, but these have yet to be broadly adopted. When future RIN sales are done via bilateral contract between parties, they are usually done for a limited span, e.g., one to two quarters, and the price is typically indexed to some average spot price over a period of time. There is no futures market to assess RIN values over the entire return on investment period of a project with certainty via hedging.

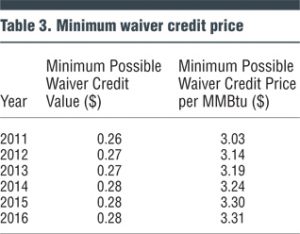

However, there is a minimum value of the waiver credit that may be considered (Table 3). Within the statutory formula, the minimum value for the cellulosic waiver credit is the inflation adjusted value of $0.25. The waiver credit value has always been higher than this minimum value, even when the reference wholesale gasoline price was in the $2.80’s in 2012 and 2013. If the advanced RIN price went to zero, this could roughly be considered the minimum value of a cellulosic RIN in the foreseeable future. The waiver credit would only go away if billions of gallons of cellulosic fuels began to be produced.

For the other part of the price equation, the lowest advanced RIN price over the last 5 years was about $0.20. And as shown in Table 2, the annual average advanced RIN price has benchmarked well above that minimum. Generally speaking, in this author’s opinion, the supply and demand for advanced fuels is tighter than it has ever been with the recent increase in RVOs for advanced fuels and very little sugarcane ethanol in the U.S. market. Market tightness tends to put upward pressure on RIN prices.

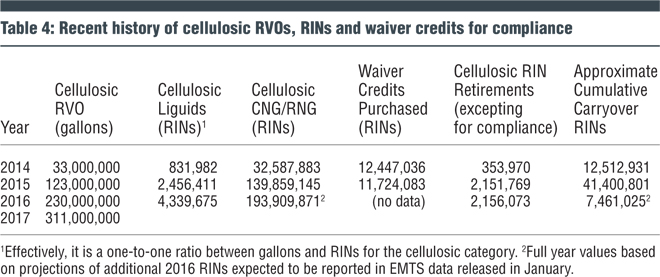

In terms of the actual demand created by the RFS, Table 4 shows the recent historic and 2017 RVOs for total advanced and cellulosic fuels. The RVO trajectory has been consistently upward and met with increasing supply as shown in the table. From time to time, RINs must be retired because of technical compliance issues; these retirements reduce the available pool and are also presented. A limited number of RINs can be used for next year’s compliance cycle. The cumulative RIN bank is shown in the last column.

RNG Supply

Based on the preamble in the EPA’s final ruling on the 2017 RVOs, at least 89 million RINs are expected to be generated by new RNG facilities supplying CNG/LNG under RFS. As of the writing of this article, there are 39 facilities registered (mostly landfill gas) under RFS for cellulosic CNG/LNG production. According to the supporting documents in the docket for the EPA’s ruling on the 2017 RVOs, there were 28 potential renewable natural gas facilities not yet registered for RFS. The EPA does not release details about these facilities, so it is unknown how many are digesters.

Each year that new supply has been demonstrated, the EPA has increased the cellulosic RVO. The agency operates under a charge to estimate volumes objectively considering the information available about existing and prospective producers of cellulosic fuels. In other words, if the supply keeps increasing, the RVO will follow if historic volume-setting methodologies continue. Bear in mind that shortfalls in RNG supply can be met with waiver credits paired with advanced RINs as long as those advanced RINs are available.

In summary, renewable CNG and LNG are playing a leading and growing role in fulfilling the cellulosic volumes of the Renewable Fuel Standard. The need for renewable natural gas continues to increase as the industry grows. Because of an all-time high waiver credit value paired with strong advanced RIN prices, renewable natural gas could fetch a value approaching $35/MMBtu in 2017. That value is without consideration of any parallel state carbon reduction benefits. To participate in the RFS program, risks associated with sometimes volatile RIN prices must be assessed and tolerated. However, there is a minimum waiver credit price that helps offset the risk. In short, the financial incentive and an increasing RVO demand trajectory are both at a point where they are creating opportunity for increased participation in the RNG to transportation fuel market.

Susan Olson, Ph.D., is Managing Director, Agriculture and Biofuels at Genscape Inc., which provides RIN quality assurance services.