Groundbreaking ReFED study systematically evaluated the food supply and consumption chain to identify scalable solutions to reduce food waste by 20 percent within a decade.

Nora Goldstein

BioCycle May 2016

Sarah Vared, Interim Director of ReFED and Principal at MissionPoint Partners, shares her key takeaways from the Roadmap development process and final report. Photo by Kenny Schick, ReFED 2016

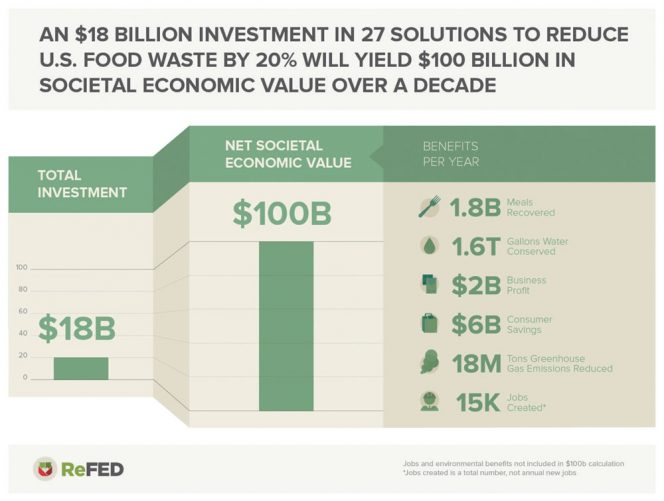

MissionPoint Partners, an impact investment firm specializing in environmental sustainability, served as the project lead. Deloitte Consulting LLP and Resource Recycling Systems led the economic analysis and core technical drafting of the Roadmap. The ReFED Roadmap (refed.com) presents an achievable path to 20 percent reduction within a decade through 27 scalable solutions that would divert 13 million tons of food waste from landfills and on-farm losses. The solutions are divided into three general categories: Prevention, Recovery and Recycling. The Executive Summary of the Roadmap includes the three most scalable solutions for each category:

Prevention: Standardized date labeling; Consumer education campaigns; and Waste tracking and analytics

Recovery: Donation tax incentives; Standardized donation regulation; and Donation matching software

Recycling: Centralized composting; Centralized anaerobic digestion; and Water resource recovery facilities with anaerobic digestion

Shortly after the ReFED Roadmap was released, BioCycle asked Sarah Vared, Interim Director of ReFED and Principal at MissionPoint Partners, about some of her key takeaways from the Roadmap development process and final report. A more comprehensive article about the ReFED Roadmap findings and strategies will be in the next issue of BioCycle.

BioCycle: What were the one or two most shocking statistics uncovered during the ReFED Roadmap research?

Vared: The Roadmap estimates that it will cost $18 billion over a decade, or roughly $2 billion annually, to reduce food waste by 20 percent. If you consider that the economic value of all the food we waste is equivalent to $218 billion annually, we only need to invest one percent of that – or $2 billion annually — to drive a 20 percent reduction in food waste. And this will ultimately unlock $100 billion in savings over a decade — over a 5x return of the investment.

BioCycle: The report uses the phrase “unlock capital” to discuss how to fund business innovation and organics recycling infrastructure outlined in the ReFED Roadmap. What has to be brought to the table to unlock capital to fund solutions on the Roadmap?

Vared: Food waste encompasses a diverse set of investment opportunities that have been on the fringe of the sector. A number of venture capital and project finance investments have funded opportunities in the composting, anaerobic digestion and food packaging sectors. More recently, innovators in waste tracking and analytics, donation matching software, and distributed recycling have also attracted risk capital.

But to date, these investments have been categorized as one-off or niche, and not combined under a broader food waste umbrella.

BioCycle: What are key strategies for unlocking additional investment dollars?

Vared: Here are three:

- Educating food businesses and cities on the benefits of adopting food waste solutions will result in a customer market pull for new products and services that will attract new private and corporate investors to invest in bringing these innovations to market.

- By demonstrating the massive social and environmental benefits of food waste solutions, we expect a major increase in funding from foundations.

- We have identified a $100 to $200 million per year gap of “catalytic capital,” or flexible investments that can de-risk new technologies and overcome key project bottlenecks. This catalytic capital is expected to prove that there are attractive risk-adjusted returns in this market, and entice a wave of additional investors.

BioCycle: What does de-risking look like for business opportunities identified in the Roadmap?

Vared: To unlock investment opportunities, capital needs to work together — impact and philanthropic capital is needed to support high-risk innovation investments, research and advocacy, consumer education, and to unlock critical system bottlenecks. These investments will enable market rate capital to enter the system more readily to scale infrastructure to recycle food waste and proven technologies to reduce food waste.

As an example, for recycling, generators need to separate out food scraps, haulers must be willing to pick up those scraps separately from traditional waste collection, and processors have to recycle those scraps into compost, energy or other products. The system won’t work if any one of those elements is missing or not operating at the same pace. Across the system there are a number of bottlenecks present, which include the high cost of capital for facilities, transportation and collection costs, roll-out of collection bins and education for businesses and consumers, and processing costs associated with contamination. Focusing capital on these bottlenecks — whether through low interest loans to reduce the cost of capital for a processor or to support high-risk innovation investments to increase the efficiency of collection and transportation — can de-risk other areas within the system for investment.

BioCycle: How technology-oriented do these companies and innovations need to be to attract capital?

Vared: Many different types of capital are available to innovators — ranging from venture capital to project finance to below-market capital available from foundations, impact investors and government incentive programs. The Roadmap estimated that of the $18 billion needed to fund food waste solutions, less than $1 billion is estimated to come from traditional private equity or venture capital funding. The largest sources are likely to be corporate investments and government tax subsidies.

BioCycle: A quote in the report states “almost $2 billion of potential profit is left on the table annually” by food businesses. How universally is that recognized by food businesses? Based on findings and solutions in the Roadmap, what strategies can be employed to make that universally recognized?

Vared: Several leading food businesses recognize that real profits are being left on the table, but there are just as many who today that do not. A first step strategy that can be employed is increasing measurement of food waste within companies. Following the adage, “what gets measured gets managed.” As food businesses start to separate out their food waste and quantify it, they see how much opportunity there is to reduce financial losses associated with it. Solutions like waste tracking and analytics and improved inventory management can be an important first step to take.

BioCycle: The Roadmap lays out four levers of action, listed below, to achieve 20 percent reduction in food waste in 10 years. Please sum up immediate action steps for each.

Vared: Immediate action steps include:

New financing to scale proven solutions: Focus on development of impact funds to further de-risk and unlock market-rate capital and further quantification of nonfinancial impacts to support more government funding.

Commonsense policy change: Develop recycling best practices for permitting, enforcement and incentives that can be implemented and maintained at the state and local level. Maintain and expand donation tax incentives to enable robust food recovery markets.

Adoption of emerging innovations: Focus on business model and technological innovations to develop new ways of sharing costs of implementation and benefits across the supply chain for food waste reduction.

Consumer and employee education: Expand consumer awareness campaigns to drive waste reductions in homes and give businesses a social license to reduce food waste. Drive employee education through new Food Waste Certifications and technical assistance. m